China’s oil and gas industry is made up of upstream, midstream, and downstream markets. These markets include the production of raw coal, crude oil, natural gas, and electric power. Oil and gas production belongs to the energy sector. Moreover, the energy sector has seen positive and negative changes amid the COVID-19 pandemic, impacting almost all other industries in China.

Have a look at our previous article entitled COVID-19 Recovery in China’s Badly Hit Industries

In March 2021, the Chinese government has released relevant import tax policies targeting the energy sector. During the 14th Five-Year Plan session, the government announced such policies to achieve the following goals for the said sector:

- Improve the system of energy production, storage, and marketing;

- Strengthen domestic oil and gas exploration and development; and

- Support the import and utilization of natural gas.

What makes up the oil and gas industry?

Raw coal, crude oil, natural gas, and electric power are what make up the oil and gas industry under China’s energy sector. It is an industry where transmission and distribution (of electricity) remains with the State. However, the industry’s power generation market has already been partly opened to private and foreign investors alike.

The change of ownership direction from State to private and foreign investors is due to the following reasons:

- To have cost-effective options

- To attract cleaner technologies for power generation

- To achieve overall sustainability

There was a time in the history of the Chinese power industry when the expansion of pre-existing generation systems that made use of cheap and available resources was a top priority, which often caused frequent local blackouts; hence, the shift to more sustainable sources came to light.

Traditionally, fossil fuels were the dominant source of energy production in China as in most countries. Due to increasing air pollution, the high carbon emission from this was internationally criticized. Renewable energy sources in the form of wind, biomass, and solar power have been developed and encouraged in recent years.

Relevant statistics for the energy sector – oil and gas industry

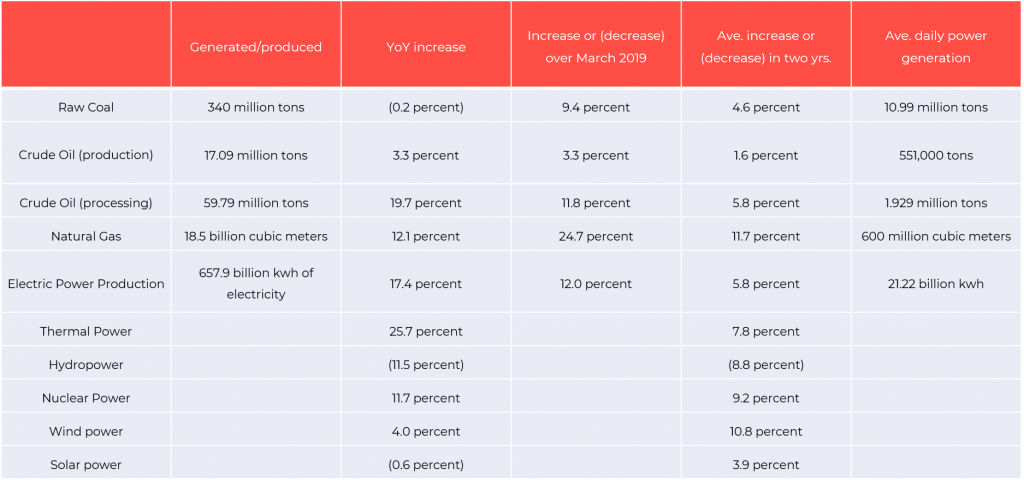

In March of 2021, the National Bureau of Statistics of China released updated statistics involving the country’s energy production. Using March 2019 as the base period, the bureau has computed each sector’s average growth rate.

- Raw coal: Production of raw coal decreased slightly for this period.

- Crude oil: Production of which accelerated including the country’s processing capacity.

- Natural gas: Maintained its rapid growth with imports increasing significantly as well.

- Electric power production: Rapid growth in this sector was seen during this period. Included in this sector are thermal power, nuclear power, and wind power generation, all of which also kept a steadily increasing pace. However, hydropower and solar power declined.

Source: National Bureau of Statistics of China

Tax policy updates for the oil and gas industry

The industry saw 27.33 million tons of coal importation, a year-on-year decrease of 1.8 percent. Thus, the government recently published relevant import tax policies to intensify its support for the industry. The State Council, through Caishui (2021) No. 17 released in April 2021, announced the following policies:

-

Self-employed projects

Self-employed projects carrying out oil (gas) exploration and development operations in particular areas within the territory of China shall be exempted from import duties.

- Import of equipment including technical information imported with equipment under contract;

- Instruments; and

- Zero accessories and special tools (cannot be produced or whose performance cannot meet the demand).

-

Sino-foreign cooperation projects

A Sino-foreign cooperation project carrying out the oil (natural gas) exploration and development operations within the winning block of onshore oil (natural gas) approved by the State and the equipment (including technical materials imported with the equipment under the contract) shall be exempted from import duties.

These projects are also exempted from the corresponding import VAT if the domestic production or performance cannot meet the demand.

-

Projects for oil (natural gas) exploration and development operations in China’s oceans

China’s oceans include the domestic sea, territorial sea, continental shelf, and other marine resources under the jurisdiction, including shallow beaches. Such projects shall be exempt from import duties and import value-added tax (VAT). These also include “old projects” for foreign cooperation approved before December 31, 1994, as well as emergency rescue projects for offshore oil and gas pipelines.

Furthermore, the following items shall also be exempt from import duties and import VAT:

- Equipment that cannot be produced or performed in the importing country

- Equipment that cannot be used directly for exploration and development operations or emergency rescue (including technical information imported with equipment under the contract)

- Instruments

- Zero accessories

- Special tools

-

Coal seam gas exploration and development projects

Projects carrying out coal seam gas exploration and development operations in China shall also be exempt from import duties and import VAT. This condition applies to their import of the following items:

- Equipment that cannot be produced or whose performance cannot meet the demand,

- Equipment that is directly used for exploration and development operations (including technical information imported with the equipment in accordance with the contract),

- Instruments,

- Zero accessories

- Special tools

-

Cross-border natural gas pipelines and imported liquified natural gas projects

The import value-added tax (VAT) of the import link shall be returned in proportion to the projects of cross-border natural gas pipelines and imported liquefied natural gas receiving storage and transportation units approved by the National Development and Reform Commission. This also includes natural gas imported from the expansion project of the import LNG receiving storage and transportation plant approved by the provincial governments.

The exact rate of return is as follows:

-

- Imported natural gas under the long-term trade gas contract signed before the end of 2014 and determined by the NDRC shall be returned in proportion to 70 percent of the value-added tax on imports.

- For other natural gas, if the import price is higher than the reference benchmark value, the VAT of the import link shall be returned in proportion to the import price of the item and the inverse proportion of the reference benchmark value.

The calculation formula for the inverted ratio is: the inverted ratio is 100 percent of the import price-reference reference value)/import price and the relevant calculation is based on one quarter for one cycle.

-

Duty-free imported goods

The first list of duty-free imported goods has been implemented since January 1, 2021, and the tax-exempt amount has been collected within 30 days from the date of the issuance of the first batch of duty-free imported goods. The list of duty-free imports for subsequent batches shall be implemented from the 20th day after the date of issue.

Those who are eligible to comply with the provisions on tax exemption may apply to the respective customs offices and choose to waive such exemptions from VAT on import links. After doing so, these companies may not apply for exemption from import VAT again within 36 months.

Conclusion

The different industries that make up the different markets of China are striving to recover as quickly and as smoothly as possible. Although some industries are coming out better than others, the economy of the country, in general, is upward looking in the coming periods. China’s economy steadily strives for a successful recovery and that includes all industries that make up the economy especially the energy sector. The maintenance of a steady recovery of the oil and gas industry requires the combined effort of all market players and consumers.

Contact us

S.J. Grand provides advisory on setting up a business in China. We put our competent team at your service to give you the most effective China market entry, due diligence, and tax optimization strategy for foreign-invested enterprises. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!