10 steps to open a foreign-invested company in China

Opening a foreign-invested company in the Chinese market can seem, and can become, over complicated. Normally, it is advisable to avoid taking this path alone, especially without good Chinese language proficiency and without a network. The business environment for Western-led companies is unique; it is more complex and controversial than any other country.

Don’t be scared, based on 20+ years of experience working and living in China, I can tell there a lot of good firms that can support your registration process. Of course, you’ll choose the most appropriate one according to your case, background, project, and budget. As a partner of S. J. Grad Finance & Tax Advisory, I saw many big failures in China, due to both a scarce level of shared information and a low level of commitment

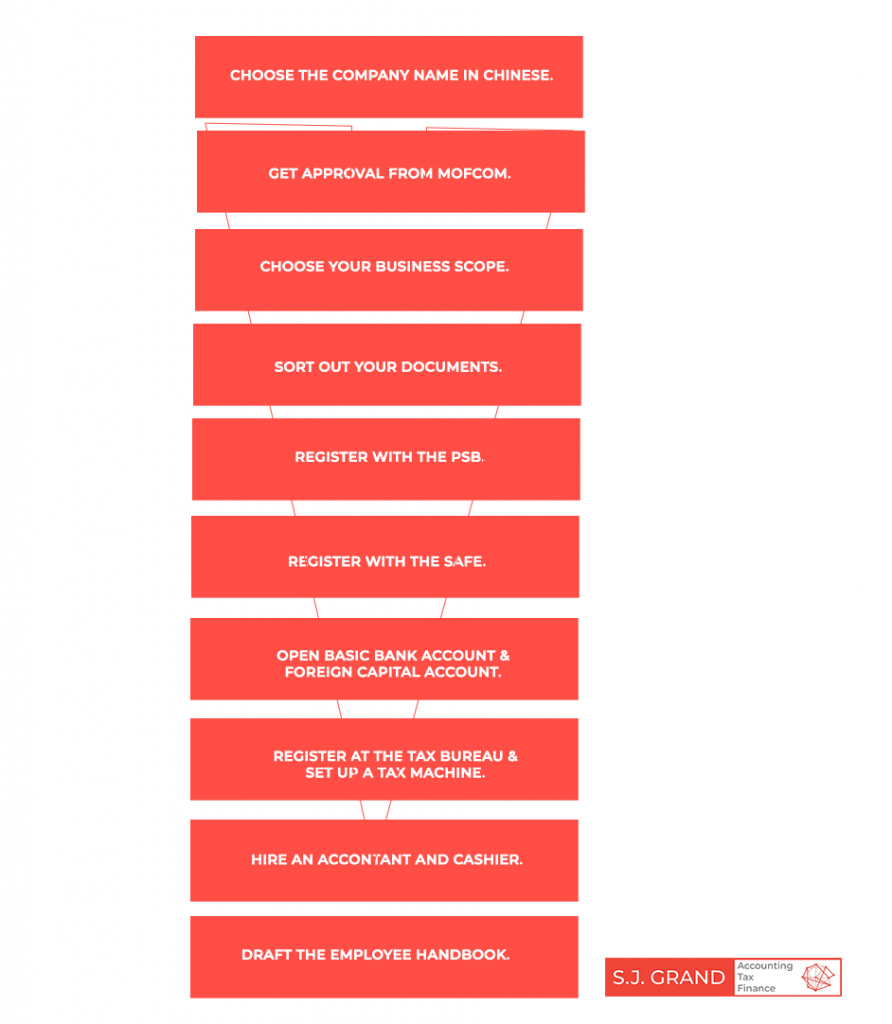

10 steps to open a foreign-invested company in China (normally defined as WFOE or FICE depending on the business scope)

I assume you already went through the strategy definition – you defined a 3 to 5 years business plan and analyzed in detail your set-up costs. Also, I hope you already made a comparative analysis of the most appropriate location to set up your company (China is huge: if one area can mean quick profits, another one can mean bad infrastructures, be careful when choosing your location).

1. Submit your Chinese name for pre-registration (approved by the State Administration of Industry and Commerce or SAIC).

1. Submit your Chinese name for pre-registration (approved by the State Administration of Industry and Commerce or SAIC).

2. Register and obtain approval from the Ministry of Commerce (MOFCOM).

Once the MOFCOM approves your documents, you will obtain the record certificate for foreign investment. As you get your Record Certificate, apply to obtain the Business License (issued by SAIC), which is the most important document to keep.

3. Choose your Business Scope.

The Business Scope is fundamental to determine the activities you can and cannot carry out in China. It should be as detailed as possible, as it will be important also to determine your tax profile. Keep in mind that some industries are encouraged, and some are prohibited to foreigners.

What happens if your business scope says you’re a trading company and you are instead producing components? Troubles, lots of trouble!

4. Sort out your documents to obtain Chinese government approval.

These documents include:

- The Chinese name of the company, which first need to be pre-registered (to choose the brand name for your Chinese entity visit www.daxueconsulting.com);

- New company legal address (which should be appropriate to your business scope and cannot be an office shared with another company);

- Company organizational chart;

- Article of Association (it also explains your intentions on company profit repatriation);

- Registered capital amount (note that today, there is no registered capital threshold to open a new company);

- Feasibility study (especially for manufacturing companies).

This list could vary according to your business scope and location.

5. Register with the Public Security Bureau (PSB).

With this registration, you should obtain the company chops, which are vital for your operations. Chops in China have the same value as the signature in the West. Without your chops, you cannot validate any contract.

What you need to know about company chops: China Company Seals: Understanding Their Role in Business

6. Register with the State Administration of Foreign Exchange (SAFE).

This can allow you to open your Foreign Currency Capital Account (USD, EUR, etc.), which can be opened in a foreign bank or in a Chinese local bank

Check out our article about Opening a Non-Resident Bank Account in China

7. Open your company’s basic bank account and foreign capital account: inject your capital.

Ask your advisor about details of opening an RMB basic account and foreign capital account to inject your registered capital and recover some start-up expenses (i.e. decoration costs, rent, consulting expenses). To set up both the RMB basic account and capital account, the legal representative must go to the bank to verify his or her identity.

More about capital injection here Foreign Capital Injection and Conversion in China

8. Register at the tax bureau & set up your tax machine.

Register the company’s basic operating and financial information such as accountant and CFO verification, tax category registration, and invoice application (which also need to be approved by the Tax Bureau).

Read more about the Golden Tax System in China: Opportunities and Challenges

9. Hire an accountant and a cashier.

10. Draft the employee handbook for your Chinese staff.

This may defend you from any possible controversy.

Know the importance of the handbook here: Employee Handbook: An Essential for Businesses in China

Depending on your industry and documents’ accuracy, the process generally takes from 3 to 6 months.

Before getting ready for the above steps, however, it is important to know the before and after aspects of opening a business in China.

Have a look at our recent post about Business setup in China: Before and After.

Contact us

Starting your own business can be daunting at first sight. S.J. Grand’s expertise, however, will guide you in the right direction.

Contact us to avail of our special services on business start-up, taxation, and more, or visit our company incorporation page to send us a request. Moreover, investing and capitalizing on Cloud-based technology for your company, such as Kwikdroid will help you in managing remotely everything with ease.

If you are interested, go to our Kwikdroid page to request a demo and see the prices and packages we offer.