Transfer pricing in China has had changes in the past few years. Moreover, the global advisory market and especially the Transfer Pricing market have also grown over the decade. The global transfer pricing market had registered a growth of 6.5 percent between 2017 and 2018 and 9.3 percent in the advisory on transfer pricing market in the same period. Moreover, the accelerating changes in the global transfer pricing are brought about by the fast-paced commercial globalization and the OECD’s regular implementation of international taxation standards.

Have a look at our previous article on Double Taxation Relief for Foreigners in China

Thus, international corporations need to keep up with all the rules and it is going to be more and more complex with the existing pandemic effects. According to the HMRC (), the aggressive use of transfer pricing and its related errors have burgeoned fines charged on multinational businesses in the last three years. Transfer Pricing in China follows suit as the country continues to align its compliance system with international standards.

What is transfer pricing?

According to the OECD definition of transfer pricing, a “transfer price is a price […] which is used to value transactions between affiliated enterprises integrated under the same management at artificially high or low levels in order to effect an unspecified income payment or capital transfer between those enterprises.”

Transfer prices are transaction prices between companies from the same group but in different countries. This is an import-export operation but in the same group. The object of this transaction could be goods and services.

Example: In the same group, a filial A established in France is selling the computer to Filial B in China, the selling price of this computer is the transfer price.

Multinational corporations use mostly transfer pricing as a method of allocating profit among their various subsidiaries within the organization. Deciding the location of your profit brings you tax advantages. Indeed, there are different tax regimes in each country, and it allows you to lower your company’s expenditure on interrelated transactions by avoiding tariffs on goods and services exchanged internationally.

Let’s take an example with two scenarios.

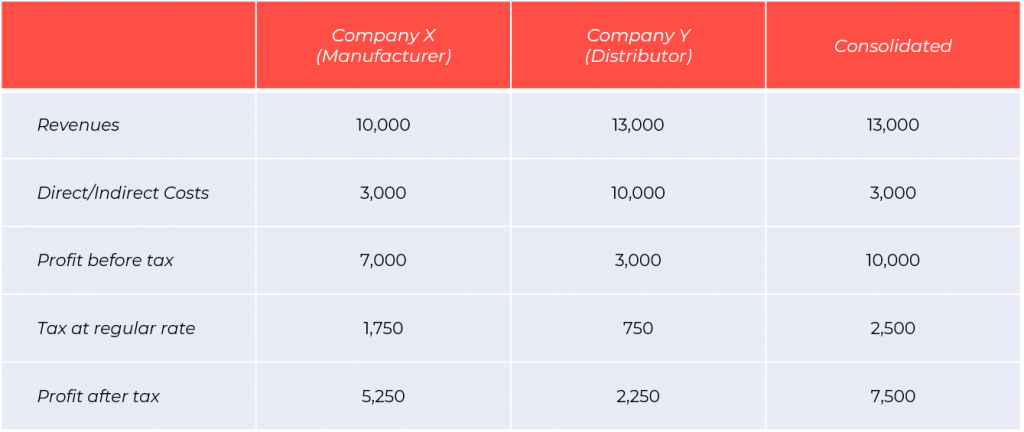

Scenario 1: X charges Y for the supply of one computer at market price (RMB 10,000 as this ensures a profit of RMB 7,000). The Malaysian tax rate is 25 percent. The production costs are RMB 3,000. This is an uncontrolled transaction.

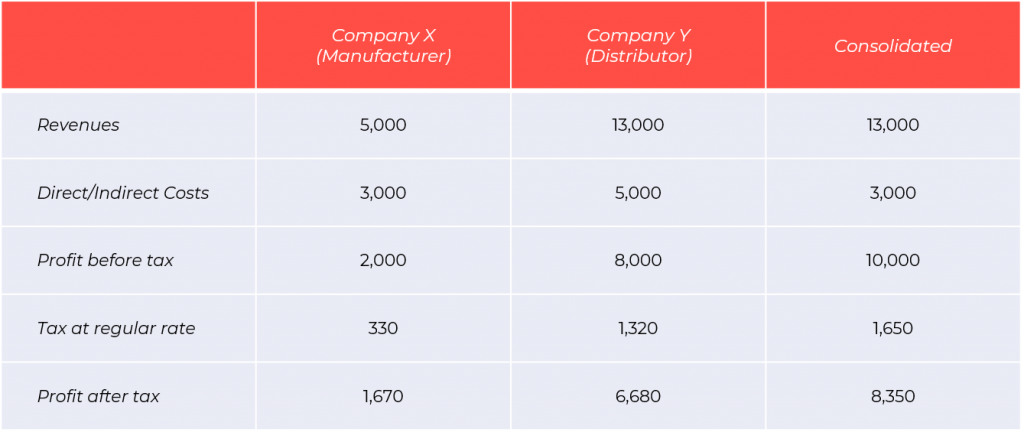

Scenario 2: X charges Y for the supply of one computer at a non-market price of RMB 4,000. The Hong Kong tax rate is 16.5 percent. This a controlled transaction (transfer pricing).

As shown above, in the second scenario, profits are increased considerably without even optimizing. That is the main point of using transfer prices. Also, the key issues here are the prices and the rates. That is why international institutions are trying to legislate on this problem.

The main benefits of using transfer pricing are clear: reducing costs into countries with high tariff rates at minimal transfer prices and vice versa. But there are some risks. First, there could be a disagreement between the different divisions of the organization. Also, transfer pricing engages costs (time and money). Finally, buyers and sellers perform different functions which result in different types of risks that are hard to identify.

This is a big problem for countries because business taxes are a big part of their revenues. Thus, to solve this issue, the OECD implemented the Arm’s length principle.

The Arm’s Length principle in transfer pricing

The Arm’s Length Principle in transfer pricing is one of the main points of the Base Erosion and Profit Shifting (BEPS) project developed by the OECD. In the 9th article of the Model Tax Convention written by the OECD, transfer prices between two commonly controlled entities must be treated as if they are two independent companies or entities. Transfer pricing in China also follows the Arm’s Length Principle even though China does not belong to the OECD. This principle tends to be the international standard for taxation.

This principle allows the government to collect their share of taxes and at the same time creates enough provisions for MNCs (multinational companies) to avoid double taxations. Hence, transfer pricing becomes a bit more complex and companies are sometimes lost in the documentation.

Method of transfer pricing

Requirements

To use transfer pricing, the international firm must fulfill some requirements:

- It should be able to prove that the terms and conditions of internal transactions are compensable to those which would have been agreed in the free market when concluding comparable transactions.

- It should keep documentation on record which shows:

- How the transfer pricing has been established;

- The transfer is in line with the Arm’s Length Principle.

Step by Step

The first thing to do is to look at internal transactions. The company must be careful about the invisible transactions within the group such as group guarantees. Then, the company should check if the terms and conditions of these transactions are following the Arm’s Length Principle. Finally, according to the first two points but also on local legislation, the company has to determine whether transfer pricing documentation needs to be prepared or not.

Chinese specifications

China authorities have been focusing on transfer pricing by enforcing stringent strong local-flavored transfer pricing regulations, imposing detailed compliance requirements, and invoking ever-increasing scrutiny on related party transactions. The tax bureau has increased control on transfer pricing in China so as to tackle tax base erosion and profit shifting.

There are different methods in China depending on the circumstances. For one, there is a limited level of tax appeal. Thus, taxpayers should avoid a tax dispute getting to the assessment stage, and companies should assess their risks and documents on their transfer pricing policies.

The method of Transfer Pricing in China

Transfer Pricing in China also follows an Advance Pricing Agreement (APA) which occurs between tax authorities and taxpayers on their future transfer policies. This mitigates the future transfer pricing risks of a company. China’s State Taxation Administration require that APA candidates must meet the following conditions:

- Related party annual transaction amount of more than RMB 40 million;

- Related party transactions have fulfilled the annual tax return obligations;

- Has presented contemporaneous transfer pricing documents in accordance with the STA provisions.

Some companies will use a Cost-sharing Arrangement (CSA) which shares the cost and the risks of the development of intangible assets. To execute a CSA, the company needs a functional analysis. A company can also use dispute resolution in defending against transfer pricing audits. However, CSA is not generally allowed in China, but in some cases, the STA can give approval depending on individual rulings.

Transfer Pricing documentation requirements in China

Enterprises engaged in transfer pricing activities must have the following three types of documentation:

- Annual income tax filing disclosures;

- Existing transfer pricing documents; and

- Other related documents required by the tax authorities.

Existing or contemporaneous transfer pricing documentation shall include documentation regarding the following aspects of business:

- Organizational structure;

- Overview of business operations;

- Related party transactions;

- Comparative analysis; and

- Selection and application of transfer pricing methods.

Conclusion

Transfer pricing risk advisory and investigations especially in China are necessary to cope with the accelerated changes in the related taxation standards as well as business operations. Moreover, enterprises should take advantage of transfer pricing restructuring in the context of the Arm’s Length Principle. Tax treatment for transfer pricing costs must also be reviewed under which company operations change, and where the associated transfer of intangible assets takes place.

Contact us

S.J. Grand provides advisory on transfer pricing in China and the intricacies involved in related party transactions. We put our competent team at your service to give you the most effective tax strategy for business restructuring as well as an analysis of taxation agreements and how you can take advantage of them. Contact us to get you started.

Moreover, our firm has been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!