Non-profit organizations (NPOs) or non-governmental organizations (NGOs) in China are citizen-based groups that function independently from the government. Organized on the community, national, or international levels, their main purpose is to aid a cause in a non-commercial fashion. More recently, donations poured into China during the unanticipated COVID-19 outbreak. Many overseas individuals, private enterprises, and government agencies delivered key materials or protective equipment through public welfare organizations or NGOs.

Read more on our previous post about Donations to China: How to Claim a Tax Deduction

What are the conditions for NGOs which conduct non-profit operations in China? Are they exempted from paying taxes? Read to learn more.

Eligibility requirement for NGOs in China

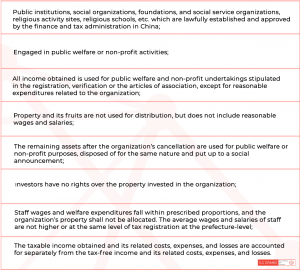

China’s Ministry of Finance and State Taxation Administration through Caishui (2018) No. 13 listed the conditions for eligible NGOs as follow:

Disqualification of tax-exempt NGOs

The following conditions may lead to the disqualification of eligible NGOs from the preferential tax exemption:

- Non-compliance to relevant laws, regulations, and national policies;

- Falsification of information during the application process;

- Tax credit rating is C or D as assessed by the taxation department;

- Transferring, concealing, or distributing the organization’s property in disguise form through connected or non-connected transactions and service activities;

- Listed with serious violations of laws and untrustworthiness by the registration management agency;

- Engaged in illegal political activities.

If disqualified for any one of items 1 through 5, the NGO’s application will not be considered for one year after the disqualification. If engaged in illegal political activities, then the finance and taxation departments will no longer accept applications for the identification of the organization.

Since taxation is the lifeblood of any country, NGOs disqualified have still to undergo and perform their respective tax obligations in accordance with the law, from the year authorities canceled or revoked their tax exemption eligibility.

Determination of tax exemptions for China-based NGOs

Eligible NGOs shall apply for tax exemption qualifications to the provincial taxation authority where they are located. They should at the same time be established or registered with the approval of the registration authority at or above the provincial level. Both the finance and taxation departments will review and confirm the requirements and qualifications of the NGO. If confirmed and qualified, the NGOs will enjoy this tax exemption for five years. Within six months after the expiration, they will have to submit a new review application. Automatic expiration awaits those that do not submit such relevant documents.

As mentioned above, the finance and taxation departments together will review and confirm the NGO’s application for tax exemption. However, these departments at all levels and their staff who violate laws and disciplines in determining the tax exemption qualifications of NGOs shall be investigated for their corresponding responsibilities in accordance with relevant state regulations such as the Civil Service Law, the Administrative Supervision Law, and others.

Documents required for application of tax-exempt status

- Application form

- Article of Association or management system or religious venues or schools

- A copy of the registration certificate

- Statement of the source of funds and details of non-profit or public welfare activities

- Overall salary report from last year (including the salary of staff or personnel, salary system, or the proportion of salary to the total expenditure)

- A certified financial statement and audit report from a qualified intermediary

- Compliance materials from the registration authority regarding the NPO’s business development and activities in the previous year

- Other documents required by the departments-in-charge

Conclusion

The government does not have the sole function to perform for the good of the community. Individuals and groups of people, in their own capacities, may also willingly give time and resources for the benefit of others.

Because of their charity nature, NGOs may be exempt from paying taxes. However, they need to undergo certain conditions, processes, and restrictions to set up a camp in China. Taxes and fees may be unavoidable entirely, especially if NGOs get disqualified from preferential tax exemption. Nevertheless, the Chinese authorities have formulated regulations to make taxing more manageable for NGOs.

To conclude, establishing a foreign NGO in China will be a breeze with help from the right people having expert know-how of China’s complex and changing taxation landscape. It should be noted, however, that foreign NGOs that wish to enter China need to set up a domestic NPO. Given that, the provisions for NGO eligibilities discussed in this article shall apply.

Contact us

If you want to know more about doing business and related taxation in China, contact us to avail of our specialist services or visit our tax and accountancy page. Moreover, you can take advantage of Kwikdroid, our easy-to-use, 24-hour access company management tool for any type or size of business.

Kwikdroid is a Cloud-based accounting and company solution that will be made available in your workplace in no time.

S.J. Grand also offers Cloud ERP services for your business if you are currently experiencing difficulty in managing your operations amid the COVID-19 pandemic. Check out our IT services page for more details.