On December 3, 2019, China’s Ministry of Finance and State Tax Administration (STA) jointly released a consultation paper on consumption tax law and is now open for public opinion until January 1, 2020. Earlier on, STA also published the notice on soliciting public comments for the Value-added Tax (VAT) law until before December 26, 2019.

Look back on our previous article 2018 VAT Reform Guidelines for China Taxpayers

Keep on reading to find out what tax changes matter to your business and why they should.

Definition: VAT and Consumption Tax

VAT (also known as value-added tax) and consumption tax in accounting are treated differently. A value-added tax is paid by sellers along the production chain including those that are coming from suppliers, manufacturers, distributors, and retailers.

On the other hand, consumption tax is imposed on specific items such as those relating to energy (for example, oil, alcohol, tobacco, etc.) or luxurious commodities (for example, vehicles, jewelry, cosmetics, etc.). Consumption tax has a role to play in regulating the production, spending power and behavior of consumers.

Draft Contents and Modifications

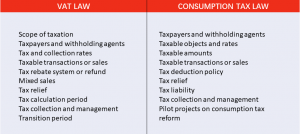

The draft for comments regarding VAT law consists of 47 articles, while the consumption tax law has 21. Each draft consists of several items including the following:

According to the draft law on consumption tax, China’s cabinet will be responsible for any tax adjustments to be made on various goods as deemed necessary. The members are also able to launch pilot programs which will make tax rate adjustments possible, inlcuding taxation on certain products. Article 20 of the draft states that:

The State Council can implement consumption tax reform on a trial basis, adjust the tax items, tax rates, and collection links of consumption tax, and the pilot scheme shall be reported to the Standing Committee of the National People’s Congress for the record.

Furthermore, the consumption tax law considers the reform of the division of income between the local and central governments. Thus, the State council members can also organize relevant tax adjustments to continue improving the local tax system.

On the other hand, the VAT law maintains the current tax structure and tax burden level. This is because the reform measures for VAT legislation (from 2012 to 2016) have already matured.

Nevertheless, the government drafted the VAT law in order to raise fiscal revenue and to introduce a modern fiscal system based on Chinese socialist characteristics. This new kind of tax system is also focused on VAT tax declaration and invoice management. It aims to improve efficiency and prevent any tax ambiguities.

VAT Law

- Sales of financial goods or products are separately listed from sales of services. The VAT is imposed only if financial goods are listed within Chinese territory or the seller is a domestic entity.

- Taxpayers whose sales have not reached the VAT threshold do not need to pay VAT. On the other hand, the purchaser is the withholding agent if the taxable transactions exist between a foreign and domestic entity within China.

- Sales of goods and process service, moveable properties and tangible assets and importation of goods – 13% tax collection rate

- Sales of transport and logistics services, telecommunication, construction and real estate rentals, intangible assets, cargoes, export/import of agricultural products – 9% tax collection rate

- Financial goods – 6% tax collection rate

- VAT rate: remains at 3%

- Goods and services in a supply involving mixed sales are treated separately, that is, VAT rules only apply where there are different tax rates and levy rates.

- Tax periods of 1 day, 3 day and 5 days are reduced to six-month tax reporting.

- There is a 5-year extension after implementation; State Council may establish special VAT preferential policies as necessary.

- Excess input VAT credits may be refundable on a permanent basis.

Consumption Tax Law

- Production, wholesale and retail sales are expressed as sales and commission.

- Deemed sales may arise from the use of manufactured goods for personal welfare or self-consumption.

- Tax deductions are clarified for taxable consumer goods purchased abroad (including cigarettes, firecracker fireworks, golf and ball equipment, wooden disposable chopsticks, solid wood flooring, refined oil, beer, wine, high-end cosmetics, etc.).

- Exporting taxable consumer goods is still exempted from consumption tax unless stipulated by the State Council.

- Taxable consumer goods should be taxed on the date they were sold and according to invoice issuance.

- Authorities will verify taxable prices and quantities if taxable consumer goods have no reasonable commercial purpose.

- Tax period calculation is also reduced to six-month reporting.

Purpose

Recently, China has been making a lot of changes in its taxation system to cater for its financial opening-up. Suffice to say, this also encourages foreign entrepreneurs to have more leeway in doing business. Furthermore, public opinions on tax-related matters manifest China’s continued efforts to elevate its business tax system and democratize its legislation.

China intends to show adherence to the OECD’s international VAT/GST guidelines with the VAT law. According to this guideline, the VAT should only be applicable for consumption and excess input VAT credits should be allowable for a refund.

In 2016, the Finance Ministry and tax administrators released a series of circulars including Circular Caishui [2016] No. 36. This detailed the shift from China’s business tax system to a VAT pilot program. However, this approach did not overcome the different systems for goods and services. Thus, it led to the introduction of VAT law.

Key Takeaways

Previously, VAT and consumption tax in China was on the provisional regulation level. With the release of the draft laws, both tax considerations have been enhanced to a state level.

The Chinese leadership continues to promote a socialist market economy at all policy levels. Therefore, the VAT and consumption tax laws at the state level forge a modern fiscal system that aligns with the same principle.If you are interested to know more about financial and tax system in China, contact our team for inquiries and follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!