According to China’s tax rules, a foreign individual with a non-domiciled tax status may be subject to taxes on income derived from overseas. By following this rule, a foreigner is exposed to double taxation given that his or her foreign income in another country also becomes taxable.

Read our previous article about Foreign Income Tax Policy for Resident Taxpayers in China

However, with the establishment of tax treaties between China and several countries, foreign individuals can now benefit from a double taxation relief by the Chinese government. Keep reading!

What is double taxation?

Double taxation refers to a taxpayer’s double tax liability in two or more jurisdictions when earning a foreign income. This dual tax can be a burden to non-domiciled individuals living and working in China if they fall under the tax residency status. Typically, foreigners in China are non-domiciled since their residency in China is temporary. Hence, a domiciled individual is one who resides in China due to household registration, family, or economic benefits. All PRC nationals are considered domiciled and must pay for both China-sourced and worldwide income.

A non-domiciled individual is subject to individual income tax (IIT) on his or her foreign income if classified as a resident taxpayer. But for a foreign resident taxpayer to avoid paying double taxes, he or she must reside in China for less than 183 days in a year. Otherwise, he or she can apply the tax treaty to claim foreign tax credits.

China’s double taxation relief for resident taxpayers

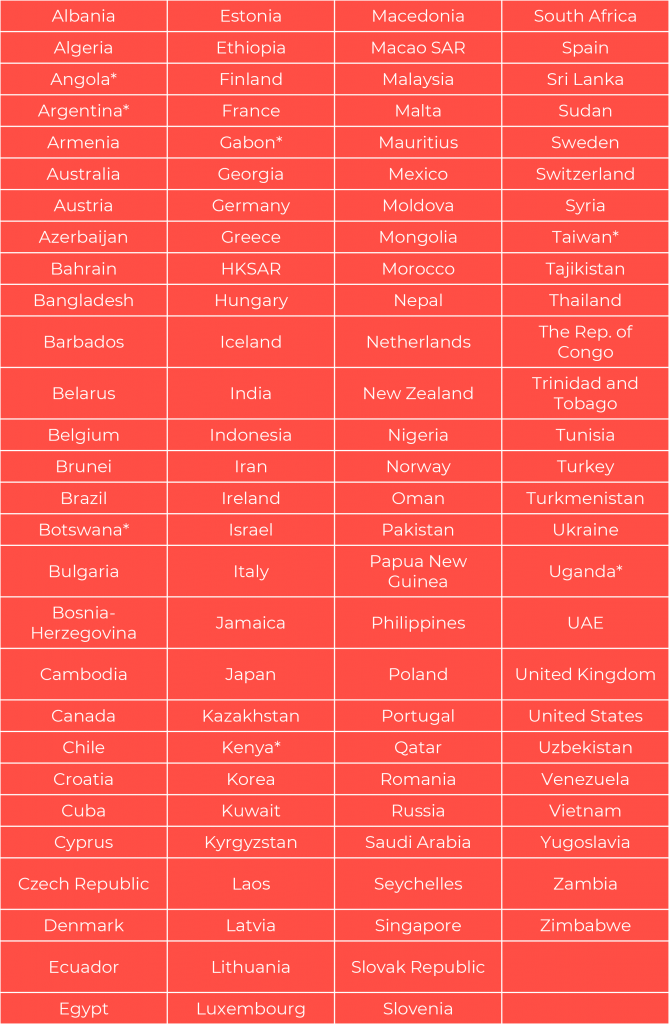

To forge its strategy of “going global”, China has signed multilateral tax treaties with several countries. The first tax treaty ever signed was in 1983 between China and Japan. As of May 2019, China has entered tax treaties or arrangements with 110 countries as shown in the table below.

*The tax treaties in these countries are not yet effective as of May 2019.

China’s double taxation agreements (DTAs) with other countries cover the payment of taxes for the different types of taxes.

- Individual income tax (IIT)

- Corporate income tax (CIT)

- Withholding tax (WHT)

- Dividend tax

Furthermore, the aspects of the tax treaties depend on every country’s agreement with China. Nevertheless, the double taxation relief entails that taxes can be reduced by 50 percent. For instance, a foreign company may be subject to taxes on its dividends at a flat rate of 20 percent. By invoking a double taxation agreement, it can save up to 10 percent of the taxes, depending on the country’s agreement. Thus, the use of DTA reduces a business entity’s tax burden at large.

Read more about the Tax Implications of Selling Your Company in China

Meanwhile, a foreign individual can claim foreign tax credits for his or her payable income taxes under the said treaty.

How to claim tax benefits under the DTA?

To take advantage of the double taxation relief, one must make an effort to fully examine and understand applicable provisions. Only then can an individual or a business can be entitled to tax treaty benefits. According to the implementing rules and regulations, a non-resident taxpayer who makes self-declaration of income taxes must submit an “Information Report on Non-resident Taxpayers Claiming Treaty Benefits“.

Furthermore, the following materials must be made available for the future evaluation process.

- A certificate or proof of identity from the country of jurisdiction proving the tax residency status (with Chinese translation);

- Related documents such as contract, agreement, board resolution or shareholders’ meeting resolution and proof of payment of income taxes;

- “Beneficiary owner” proof of identity for tax claims on dividends, interest, or royalties under the tax treaty;

- Other materials deemed satisfactory to prove qualification under the DTA.

A foreign individual eligible under the tax treaty and has overpaid taxes can get a refund through self-application or a withholding agent. Local tax authorities will review the refund application within 30 days and then release the overpaid tax amount.

You may refer to the English translation of the State Taxation Administration’s Announcement 35 [2019] for more details.

Advantage of DTA on foreign enterprises

Among those who can benefit a lot from tax arrangements include trading enterprises due to their association with a permanent establishment. Cross-border tax charges on profits gained by trading enterprises with no PE are not applicable. Therefore, they are exempt from paying taxes for their business income. A PE refers to the actual business presence of a foreign company in China. Moreover, it can also refer to dispatched employees or personnel to China, independent agents, or construction or building sites.

Foreign-invested enterprises can remit their dividends (profits) with huge cuts on withholding taxes. As mentioned earlier, withholding taxes on dividends can reduce by half following a tax treaty application. Thus, shareholders of multi-national companies can save a significant amount of their profits supposedly accounted for payable taxes.

Conclusion

The implications of a double taxation treaty may vary for different business structures or dealings and many companies may be unaware of its benefits. On the other hand, local tax authorities in China may be unfamiliar with the full extent of the DTA applicability or its processes. Hence, it is best to seek professional advice or assistance before going through self-application procedures.

Contact us

S.J. Grand’s tax and accountancy services will keep your business updated with the various policy changes in China every year and what steps to take to remain compliant with the Chinese income tax regulations. If you want support for understanding the conditions and applying for your tax treaty benefits, contact us for consultation and assistance.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!