Recently, China’s State Taxation Administration announced the implementation of special VAT “e-fapiao” in the jurisdiction of Ningbo and Zhejiang province. This means that the fapiaos which are normally issued on paper will now be available electronically. Following this, the invoice will also have the electronic version of the red stamp or most known as the company seal.

Have you read about China Company Seals: Understanding Their Role in Business

If fully implemented, the new e-fapiao system will benefit businesses as well as tax professionals in China who mainly rely on physical invoices to manage accounting processes.

E-fapiao for enterprises

Since 2016, the STA has piloted the e-invoicing system for general VAT fapiao for many cities such as Shanghai, Beijing, Shenzhen, and Zhejiang Province. From then, service-based companies could utilize the general VAT e-fapiao for their business transactions.

On the other hand, Ningbo piloted the first e-invoice program for special VAT fapiao in August 2020 which was later fully implemented by September 2020. From October 16, 2020, the STA began expanding the e-invoicing system for special VAT fapiao in Zhejiang province. According to the announcement, the electronic invoice shall use electronic signatures instead of the special invoice stamp. Furthermore, if the enterprise uses the printout of the e-fapiao as a tax voucher, it should also ensure that the original VAT e-fapiao is safe and secured. In case of loss, the holder of the e-fapiao can download the original e-fapiao from the National VAT Invoice Verification Platform. Meanwhile, the issuer of the invoice may still provide the original e-fapiao if the paper copy of the e-fapiao is lost.

The tax administration also noted that electronic image files such as photographs, screenshots, scans, etc. are not considered as electronic accounting documents. Therefore, they cannot be used for reimbursement purposes but can only be filed as electronic copies. Nevertheless, the bureau emphasized the availability of “unstamped” e-fapiaos in the future as the main trend for electronic invoices.

3 ways to generate the e-fapiao system

- Obtain approval for the type and maximum limit of the invoice.

- Receive the Ukey from the tax bureau which is a tax control equipment containing a digital certificate.

- Log onto the State Public Service Platform of Electronic VAT Invoice to issue the special VAT e-fapiao.

On the other hand, enterprises can also build their own e-fapiao platform or use a third-party with the e-fapiao service platform to issue an electronic invoice.

Advantage of e-fapiao to enterprises

Enterprises do not need to go to the local tax office in person for fapiao-related processes such as applying for paper fapiao or validating special VAT fapiao. Besides, they can also save financial resources by not purchasing special printing equipment for scanning fapiaos. In terms of accounting, enterprises can save time and lessen the workload by using a paperless invoicing system.

Contactless tax payment

During the COVID-19 outbreak in China, tax administrators launched several tax payment policies for individuals and businesses. Moreover, they implemented eight new measures to facilitate the tax contributions of enterprises. Some of those include:

- Building online appeals and direct exchange channels of taxpayers’ opinions. To widen the scope of opinion gathering, and accurately analyze and give timely feedback on the actual demands of micro-enterprises.

- Optimizing the tax-related illegal information inquiry services. To enhance compliance with tax laws upon small enterprises, the provincial tax bureaus rely on the electronic tax bureau to provide small micro-enterprises with tax-related illegal online inquiry services.

Tax authorities have also actively expanded the “contactless” tax payment matters while providing safe, efficient, and convenient services to taxpayers, and effectively reduce the risk of spreading the epidemic. They have launched several online transaction platforms including the tax bureau website and its mobile app version where taxpayers can have a better experience. Through the tax app, taxpayers and businesses can manage IIT return and refund applications, as well as performing inquiries on their tax statutes.

Have a look at our previous article on IIT Return App for Taxpayers in China

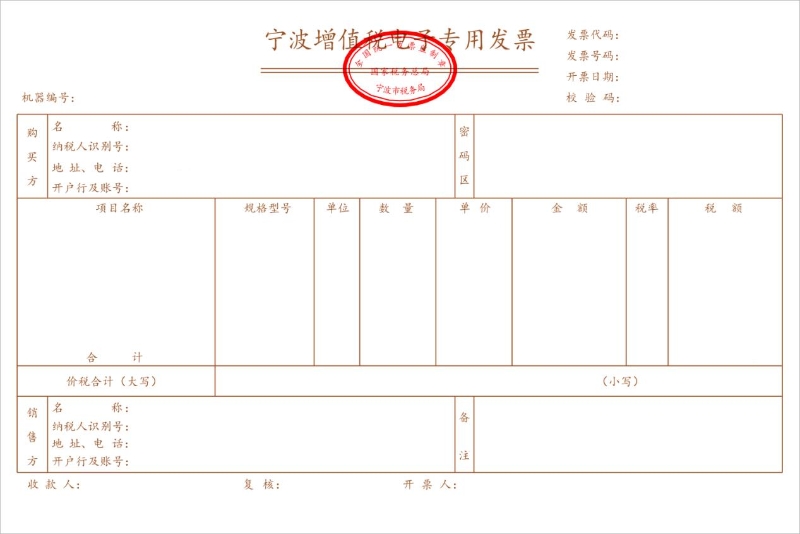

Sample of special VAT e-fapiao from the State Taxation Administration

Tax services in China – a backgrounder

Twenty years ago, the digital frontiers of taxes in China have not yet been established. Looseleaf services were maintained in libraries of tax professional services firms. Librarians could rip a leaf or page (hence the term “looseleaf”) from the book and replace it with a new page consisting of new legislation, case law, commentary updates, etc. Looking up the relevant provisions and applying them in an easily understandable manner were the bulk of tax advice given to clients then. In other words, practitioners were paid for the information that clients had no access to. Also, physical offices, stores, factories, or other permanent premises were true for all businesses in the past.

The role of tax professionals

Fast forward twenty years into the future, tax practitioners are now paid for their insight, familiarity, and professional judgment instead of looking up laws. Clients are now able to do so on their own with the emergence of readily available information on the internet. Clients tend to seek from tax professionals, among others:

- Insight: Further understanding of what information from the internet means and how those can be applied in their businesses.

- Benchmarking: Instead of asking what they should do, clients are more inclined to ask “what do others do?”. Incidentally, tax authorities look for statistical outliers and then use those as the basis to raise queries and to carry out audits and inspections.

- How much?: The actual amount of money in taxes they would have to pay in compliance with existing tax laws.

These days, obtaining data from a company’s accounting software and the Golden Tax System is still not as sophisticated can be, since much of the audit trail required for monitoring still highly relies on paperwork stored in spreadsheets. With the help of continuous government efforts such as the e-fapiao service and the expertise of available technology (i.e. digital accounting) and professionals, sophistication in the digitalization of tax services will eventually be achieved.

Check out our article on Digital Accounting with Kwikdroid’s Unbeatable Value

Conclusion

Tax services have changed throughout the years. The taxation process has become more complicated than ever, but tax professionals and practitioners all over the world have evolved as well. And thanks to digitalization, globalization, and modernization, the sophistication of the tax process is already underway.

China’s digitalization of its tax services provides the ultimate convenience to many enterprises operating in the country. The e-fapiao system is a major initiative for these developments. However, companies must ensure to apply the necessary adjustments and train their staff regarding the use of the e-fapiao system.

Contact us

S.J. Grand’s tax and accountancy services extend to assisting your business with the management of the e-fapiao system and the Chinese government’s digitalized platforms such as the e-tax app. Contact us for consultation and assistance.

Moreover, if you are interested to learn about our latest Cloud-based company solution, go to our Kwikdroid page to check the prices and packages we offer, no matter the size or type of company.