China’s State Taxation Administration has launched several pilot programs for electronic invoice systems in few cities in China. In December 2020, the e-fapiao extended further to other regions and is expected to roll-out nationwide this year.

Have a look at our previous article on E-fapiao and the Digitalization of Tax Services in China

The fapiao digitalization intended for invoicing purposes in China will become fully effective soon. It will replace the current paper-based fapiao system where it requires business personnel to visit the tax office.

Which regions have commenced the electronic invoice pilot program?

Since January 21, 2021, the following regions have started implementing the pilot program for the electronic special VAT fapiao:

- Beijing, Shanxi, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangxi, Hainan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang, Dalian, Xiamen, and Qingdao.

On the other hand, regions that have already started the pilot program from September to December 2020 include:

- Ningbo, Hangzhou, and Shijiazhuang, Hangzhou, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Anhui, Guangdong, Chongqing, Sichuan, Ningbo, and Shenzhen.

How to use the electronic invoice or e-fapiao system?

Selected enterprises for the special VAT e-fapiao pilot program use the government’s Public Service Platform of Electronic VAT invoice after getting certification and obtaining the ‘U-key’ log in the terminal. This enables the electronic signature on the electronic invoices. Businesses can request what type and number of sales invoices they wish to issue, but only upon approval.

The electronic invoices will be stored in the said public platform for easy retrieval. On the other hand, businesses must apply for credit notes through the portal via ‘red-lined’ special invoices.

The e-fapiao application for general VAT invoice has already been implemented since 2015. Therefore, the pilot programs targeted the implementation of e-invoice for special VAT which allows for VAT refunds. Initially, the special VAT invoice is obtained through specific software and only certified suppliers can issue the document. Businesses were also required to obtain this invoice in person.

Clearance system

Issuers of e-fapiao must submit the invoices to the STA first before sending them to clients. Moreover, the method of transmission may vary but the format of the electronic invoice will be in OFD. For rectifying the invoices, the lettering must be kept in red.

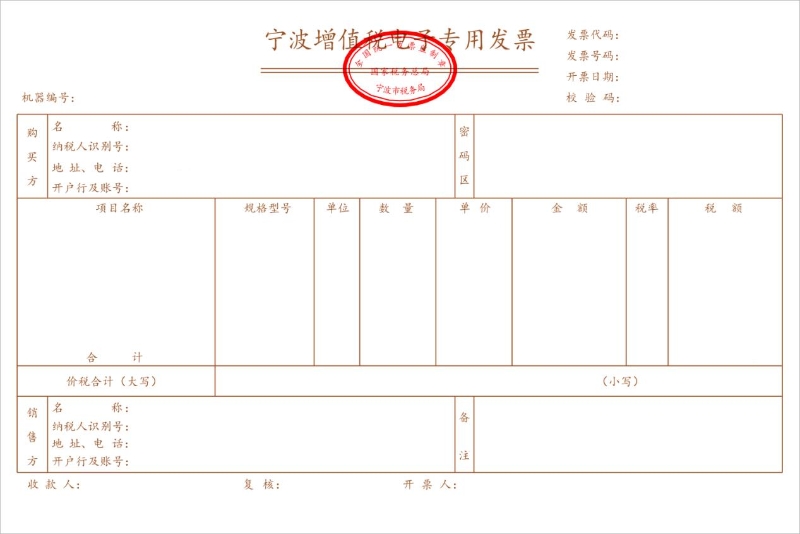

Sample of special VAT e-fapiao from the State Taxation Administration

Electronic signature for electronic invoice

Electronic invoicing will have to require the usage of electronic signatures, replacing handwritten ones and stamps.

In 2019, the Standing Committee of the National People’s Congress released the revised law on electronic signature under which the conditions for the use of electronic signatures are described.

Advantage of e-fapiao to enterprises

Enterprises do not need to go to the local tax office in person for fapiao-related processes such as applying for paper fapiao or validating special VAT fapiao. Besides, they can also save financial resources by not purchasing special printing equipment for scanning fapiaos. In terms of accounting, enterprises can save time and lessen the workload by using a paperless invoicing system.

Rules on archiving electronic documents for accounting

An electronic document can be used for all kinds of accounting-related matters such as reimbursement, entry, and filing. It will have the same legal effect as the paper invoice but may only be used under the following conditions:

- The electronic document is verified as legal and authentic;

- The transmission and storage of the electronic document is proven safe and reliable, that is, it can immediately detect any kind of tampering;

- The accounting system used must be accurate, complete, and effective in terms of receiving and reading e-documents; accounting operations must be in accordance with the golden tax system;

- The filing and management of the e-documents are compliant with the “Administrative Measures on Accounting Files” (Order No. 79 of the State Archives Administration of the Ministry of Finance).

Hence, the above conditions count for archiving electronic accounting materials such as the following:

- Accounting vouchers, including original vouchers and bookkeeping vouchers;

- Accounting books, including general ledgers, subsidiary ledgers, journals, fixe asset cards, and other auxiliary account books;

- Financial accounting reports, including monthly, quarterly, semi-annual, and annual financial accounting reports;

- Other accounting materials, including bank balance adjustment statements, bank statements, tax returns, accounting file transfer lists, accounting file storage lists, accounting file destruction lists, accounting file appraisal opinions, and other accounting materials with preservation value.

In addition to the conditions for storing electronic documents, the enterprise must establish a backup accounting system for such electronic files. This is expected to prevent the impact of natural disasters, accidents, or man-made damages. Moreover, the electronic accounting materials formed should not belong to accounting files with permanent preservation value or other important preservation values.

The storage period for archiving accounting materials both for paper and digital can be permanent or regular. The regular period for storing accounting files is divided into 10 and 30 years.

Conclusion

The use of e-invoicing is not yet mandatory and automating the whole process of electronic invoice transmission remains to be underway. However, with more cities and regions participating in the pilot programs, China shows absolute intent to implement the system nationwide. China has been overhauling its tax system for the last few years and the special VAT e-fapiao is part of phase 3 (out of 4) of the country’s golden tax system.

Businesses must prepare for such changes in the tax regimes and continuously track the implementation processes. This will help mitigate any tax risks and manage the accounting of business accurately and safely following the law.

Contact us

S.J. Grand’s tax and accountancy services will keep your business updated with the various policy changes in China every year and what steps to take to remain compliant with the Chinese regulations. Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Contact us or visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!