On March 17, 2020, China’s Ministry of Finance announced significant measures related to export trade. The ministry implemented the measures on March 20 to support trading companies involved in the export of applicable goods. On the other hand, Shanghai also released measures concerning imported materials and other important policies to aid businesses impacted by the COVID-19 outbreak.

Read our previous post about Shanghai Government to Aid Businesses Hit by COVID-19

The Chinese government expects the epidemic prevention and control measures to bring immediate relief to foreign trade and businesses. Keep reading for more details.

Export tax rebate increase

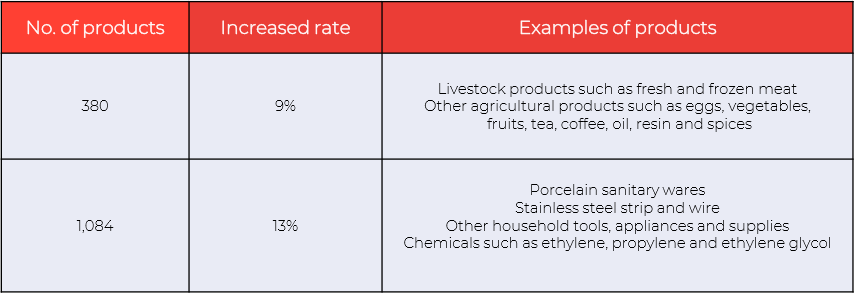

The State Administration of Taxation indicated in its notice that the export tax rebate rate for 1,464 products will be increased at different levels.

The table below shows the details of the increased export tax rebates.

According to further announcements, the increase in the export rebates aims to achieve the following outcome:

- Reduce the operating costs of enterprises,

- Improve the global competitiveness of export products and;

- Boost the confidence of export trade enterprises.

Furthermore, the SAT’s notice emphasizes the exclusion of rebates for products that require high energy and resource consumption. Moreover, products with high-pollution consumption are also exempt from the increased tax rebates.

Application for export rebates

During the epidemic prevention and control period, the tax bureau implemented several “non-contact” processing of taxes. This includes the application for tax rebates. Enterprises were advised to handle business-related applications online and make use of 12366 tax service hotlines and other online platforms.

Nevertheless, enterprises eligible for the increased export rebates must provide their business licenses and approval documents for export. They are also required to stick to the monthly tax declaration.

To alleviate the burden of handling tax refunds, the tax administration also moved to shorten the application processing time from 10 to less than 8 working days.

VAT refund on research and development industry

Domestic and foreign institutions under research and development will also enjoy a full refund of VAT concerning the purchase of domestic equipment. The refund period has applied from January 1, 2019, until December 21, 2020.

Furthermore, the above institutions can apply for tax declaration of their domestic purchases before August 21, 2020 instead of the scheduled date on April 30, 2020.

Key takeaways

Upon implementation of the tax rebate policy, SAT has already approved export tax rebates worth RMB204 billion for almost 230,000 export enterprises. Thus, it effectively reduced the financial pressure among the export trading companies.

Due to the widespread factory shutdown during the virus outbreak, China’s economy has experienced a sharp decline in its industrial output. The rebates, however, may have helped in lessening the impact of reduced trade amid the COVID-19 pandemic.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!