If you’re familiar with Chinese business customs, you’ve heard of the Fapiao

Fapiao translates directly to “invoice”. However, simply translating the term is not enough. Fapiaos are a little more complex than simple invoices and different types are available. What many may not realize is that a Fapiao is both a legal receipt and a tax invoice. Firstly, it serves as proof of purchase for goods and services. Consecutively, it’s a way to determine the tax paid on a given transaction.

If you’re planning to expand your business to China, you need to be familiar with this type of invoicing. Keep reading as we will introduce the ins and outs of the Chinese Fapiao system!

Take a look at some of our previous posts: Visa-free stay – 144 hours available in even more Chinese cities

Fapiao – the essentials

The State Administration of Tax (SAT) prints, distributes, and administers Fapiao. Authorities then require all businesses to purchase relevant Fapiao, according to their business scope. This is also what makes a Fapiao so special – a business may not print their own Fapiao and issue it then. A legitimate Fapiao may only be issued by the government, from whom the retailers then buy the Fapiao.

The Fapiao is a core part of China’s tax law and is critical for compliance purposes for businesses operating in the country.

This receipt allows businesses and tax payers to meet the legal standards required by China’s tax system, but also to keep track of all business transactions among enterprises.

Generally, a Fapiao means that a company must report taxable income. Receiving a Fapiao from a business means that the transaction at hand is taxable. The company will need to pay taxes from the money you give them.

Companies can generally issue a maximum of 50 ordinary VAT invoices and 25 special VAT invoices monthly. The amount to be invoiced may not exceed RMB 100,000.

Fapiao Functions

As explained earlier, a Fapiao is an official receipt, which serves as an invoice. A Fapiao serves different purposes for different parties:

- For individuals: A Fapiao is needed to reimburse business expenses. Businesses will also require one when returning a purchase or to access other possible after-sales services.

- For companies: Businesses require a Fapiao to record business transactions. It’s also used for accounting and tax deductions.

- For the government: China’s tax authorities require businesses to use a Fapiao to compel companies to pay tax, serving as a paper warranty against tax evasion.

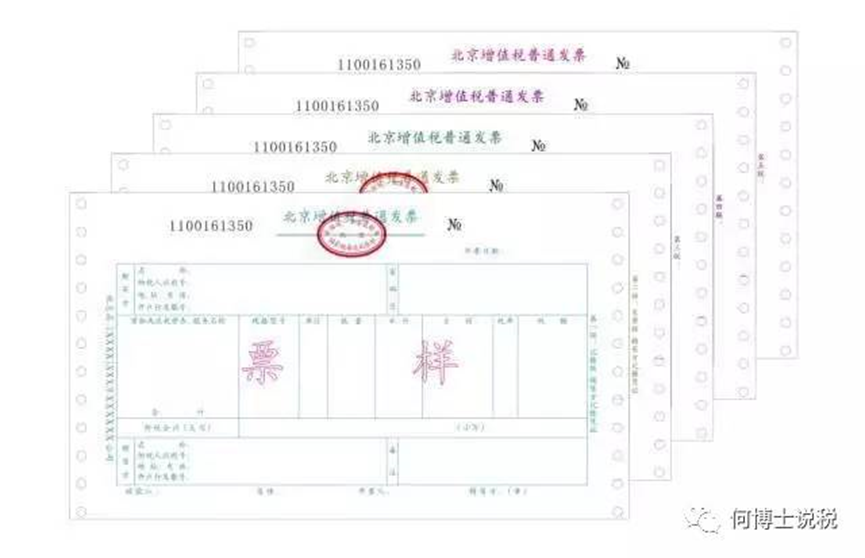

Types of Chinese Fapiao

There are two main types of Fapiao available in China:

- General VAT Fapiao: issued in regular circumstances, where special VAT Fapiao does not apply, by a business of any size. A regular Fapiao can be issued in the event of: sales of goods, tax-free services, or VAT registered operations. These Fapiao are typically employed by business taxpayers, VAT small-scale tax payers, and VAT general taxpayers who are not permitted to use special VAT invoices. Businesses that fall under this category are usually general commercial taxpayers, offering goods like cigarettes, alcohol, food and other consumer goods.

- Special VAT Fapiao: issued by taxpayers to consumers when selling goods or providing taxable services. Bookkeepers issue special VAT Fapiao to their customer for services rendered. Note, that a special VAT Fapiao may not be used for the sales of tax-free commodities. Another important feature – special VAT Fapiao can be used for tax deduction, whereas general Fapiao cannot.

Additional Features

- Regardless of the type of Fapiao issued, they must contain the following key information: trader’s tax code, their address, telephone number, and all relevant bank account information.

- The seller must include its special Fapiao chop.

- The fapiao must describe in detail the type of goods or services provided as part of the transaction.

- The issuer must link their internal Fapiao data with the government. This ensures that when recipients of the Fapiao file their taxes, the amounts and the descriptions will match in the system.

- For internal auditing, each invoice must have a unique running account number to prevent invoice duplication or jump numbers.

- Cipher text of Printed General VAT Fapiao has 103 digits; while Special VAT Fapiao has 84 digits.

Further Considerations

Chinese authorities regularly use the Fapiao system to fight income tax evasion. Hence, Chinese tax authorities demand that businesses use Fapiao to pay tax in advance of their future sales. In case an enterprise fails to provide a Fapiao upon request to a customer, the former constitutes as an illegal act. All business transactions must be recorded on a Fapiao, as required by law.

For individuals, Fapiao serves as proof of expenditure in situation where one needs to claim business expenses. There are instances when a business owner is not willing or unable to provide a Fapiao. In this case, the customer has the right to report the company to a local tax bureau.

A Fapiao is written totally in Chinese, which often complicates the process for foreigners. In order to avoid facing fines and penalties, but rather ensure compliance, we suggest consulting with professional advisors. A proper support will be of great help when being audited by local tax authorities.

We also suggest you pay close attention to something called Xiaopiao – another type of receipt in China, issued as evidence of a purchase. These are not official documents and cannot be used for reimbursement.

Fapiao and Foreign Companies

In general, Chinese companies do not issue Fapiao when dealing with overseas customers. However, if they do, you may treat the it as an invoice or a receipt. When Chinese companies pay to foreign suppliers, they will not get a Fapiao – the overseas company does not have one. In this situation, the proper money remittance process for the Chinese company will generate a similar official document for it to claim the expense.

If a foreigner is running their business in China, it is suggested to get to know how a Fapiao affects the business and how to properly manage related paperwork and logistics. Pay close attention when procuring or preparing Fapiao. Remember to make a proper tax plan, as the Fapiao reflects the tax-paid status of a company. If all is done correctly, the company will be given more quotas in applying for foreign staff work permits in the future – definitely a huge benefit!

Need advice on finding the best strategy for your company in China? Get in touch with our team for a consultation and follow us on social media to receive the latest news

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

Also, don’t forget to follow us on social media to receive all the latest updates!

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!