On January 17, 2020, China’s Ministry of Finance and State Taxation Administration jointly announced a new policy concerning the handling of taxes for foreign income. The new policy underlines the basis of non-China sourced income and how taxable income is calculated. It is also important in understanding the tax implications of working and doing business in China.

Read our previous article about Tax Implications of Selling Your Company in China

On the other hand, the policy also clarifies details regarding foreign tax credit which is used to avoid double taxation. All resident individuals and enterprises must take note of such a policy that could impact personal earnings and corporate investments. Read more.

What is considered a foreign or overseas income?

- Salaries, wages or remuneration derived from overseas employment or provision of services

- Payment to authors by an overseas enterprise or organization

- Royalties received from concession grants

- Business income from outside China including manufacturing and operations

- Interest, dividends, and bonuses derived from overseas

- Leasing income from overseas properties

- Income from the transfer of immovable foreign properties or investments (i.e. stocks, equities, assets, etc.)

- Incidental income obtained from enterprises, organizations, or non-resident individuals

- Other classifications by MoF and STA

Calculation of taxes for overseas income

The Chinese government levies taxes on China-sourced and worldwide income of tax resident individuals. Under the new policy on worldwide income taxes, both domestic and overseas income shall be combined when calculating taxes for IIT purposes.

The same calculation also applies to the individual’s business income. However, business owners cannot use any incurred losses from their overseas income to offset taxes on their China-sourced income. Thus, they may only carry forward such losses to future tax years and use it to offset their profits or operating income at the same overseas location.

On the other hand, overseas interest, dividends, bonuses, other income, and their equivalent taxes shall not be combined with China-sourced income. Hence, the taxation department will separately calculate the payable taxes for these income categories.

What is a foreign tax credit?

In 2009, China’s finance ministry and tax administration announced that China resident enterprises may claim paid foreign taxes in the form of a credit on their tax returns. Foreign taxes refer to the corporate income tax (CIT) paid by resident enterprises on their taxable worldwide income.

Furthermore, non-resident companies or enterprises also carry CIT on their foreign income, and therefore, can claim a foreign tax credit (FTC). However, the condition only applies to non-resident companies with an establishment or place of business in China. Non-resident companies not only pay taxes on their foreign income but also on their China-sourced income that is derived from their business establishment in China.

Tax authorities consider the country jurisdiction from where the overseas income is derived when calculating the FTC. This means that a creditable tax must follow CIT laws and regulations of the foreign country or region where the resident enterprise paid the actual amount. Therefore, it is also important to consider existing tax treaties between China and some countries.

Taxpayers can no longer refund unclaimed tax credits after 5 years. Moreover, the competent tax body would require documentation such as tax certificates or clearances on foreign taxes as evidence to support the FTC claims.

Calculation Formula for FTC

Tax or refund due for the tax year = total tax liability-overseas tax liability allowable as a credit (not more than the tax credit limit)

How to calculate the FTC limit per income category?

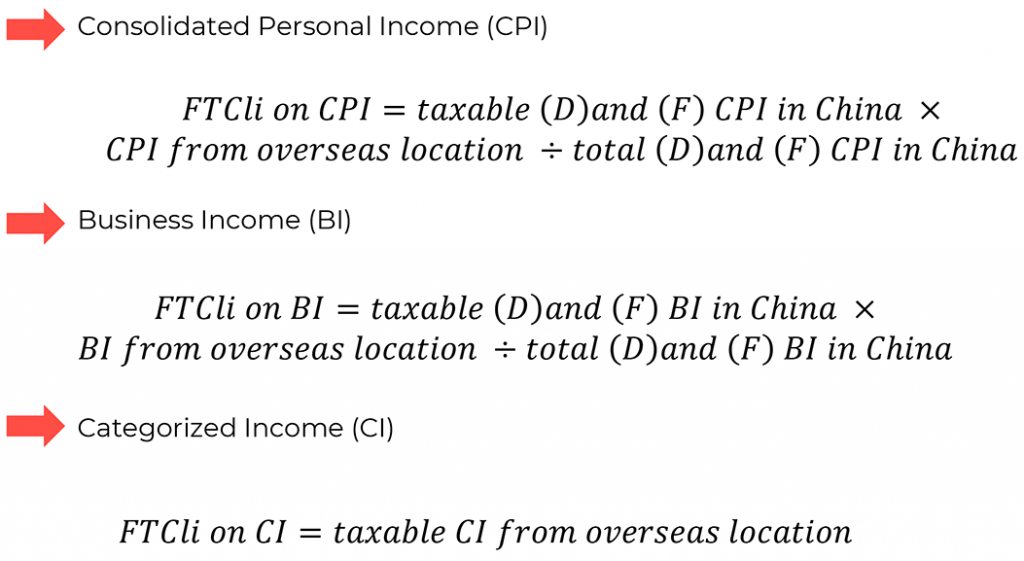

According to recent Announcement No. 3. 2020 published by MoF and STA, the FTC limit is calculated based on the overseas jurisdiction and the overseas taxes paid for consolidated personal income, business income, and other income within a tax year.

The details below show the methods or formula in calculating the FTC limit per category of income:

- FTCli: foreign tax limit

- CPI: consolidated personal income (comprehensive income including salaries and wages)

- BI: business income or business operating income

- CI: categorized income or other income

- (D) and (F): domestic and foreign (China-sourced and overseas income)

Foreign income taxes NOT allowable for FTC

- Paid or levied inaccurately

- Non-taxable under the Double Tax Treaty between China and the foreign country (including Double Tax Arrangement between Mainland China and Hong Kong and Macao)

- With additional interest or fines due to late payment or underpayment

- Already due for refund or compensation in the overseas jurisdiction

- Exempted from taxes per China IIT Law and Implementing Regulations

Administration of foreign income reporting and FTC claims

Resident individuals or enterprises have to file their overseas income within a tax year from March 1 to June 30. They need to report to the local tax authority where their employers are located. On the other hand, taxpayers who do not have an employer in China can report to the local tax bureau following their household registration. Otherwise, they can do the tax filing at their habitual place of residence.

As mentioned earlier, the tax administration requires sufficient documents to support any FTC claims. These include tax certificates or records of payments issued by the respective overseas authorities. In the absence of these papers, the taxpayer can present tax return or tax filing documents along with proof of payment (i.e. bank transfer records).

Employees assigned overseas also incur payable taxes on their foreign income. Hence, they also need to know about the various withholding and reporting requirements. If your company seeks further assistance regarding this matter, you may contact our team to help with your tax-related proceedings.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!