On July 1, 2020, China’s State Taxation Administration has implemented preferential taxes for tourists on the resort island of Hainan. Moreover, it also released a new regulation concerning offshore duty-free shops that took effect on November 1, 2020. Recently, STA also announced the “zero-tariff” policy for self-use production equipment in Hainan Free Trade Port.

More news for China tourists here: WeChat’s New Digital Tax Refund for Tourists in China

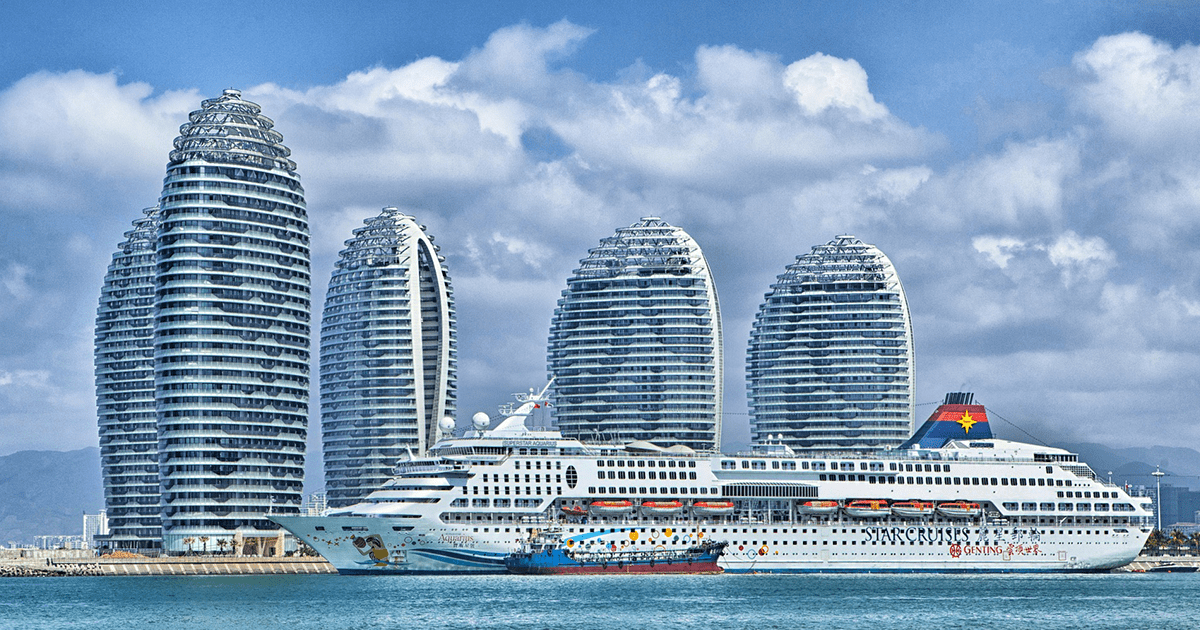

Hainan is bouncing back from the impact of COVID-19 on its tourist-based economy. Thus, Chinese officials are gearing up to make business and shopping spree alive again on the island.

The zero-tariff policy for self-use equipment

According to the zero-tariff policy, imports of self-use equipment intended for production have been exempted from customs duties, import VAT, and consumption tax. The equipment pertains to those used for production and operation activities in the following areas:

- infrastructure construction;

- processing and manufacturing;

- R&D and design, inspection, and maintenance;

- logistics and warehousing;

- medical services; and

- cultural and sports tourism.

The said policy has been implemented since February 2021 and still continues until further notice.

New duty-free policy for Hainan shoppers

China’s STA announced an offshore duty-free policy including the increase in the allowable value, quantity, and category for duty-free shopping. The duty-free policy exempts the sales of goods from standard taxes such as customs duty, import value-added tax (VAT), and consumption tax. However, consumers cannot resale these tax-free commodities in the domestic market.

Increased quota and limit removal

From previously RMB 30,000, the annual duty-free shopping quota has been increased to RMB 100,000 per person with no limit on times of purchase. Furthermore, STA also removed the limit of RMB 8,000 for a single tax-free commodity.

Added categories

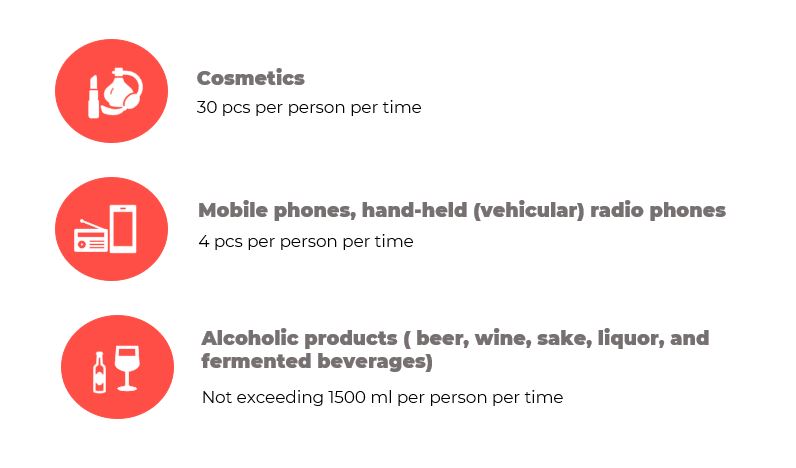

The tax administrators also decided to augment the categories from 38 to 45 under which consumers can purchase commodities. They also increased the purchase limit for some products including cosmetics, mobile phones, and hand-held (vehicular) radio phones, and alcoholic products.

Following the provision, the competent authorities will regard commodities with single integral packaging and independent prices as one piece. On the other hand, they will calculate the actual amount of goods contained in the package of suite products.

You can find the list of commodities with unlimited purchases here.

New picking method

STA also introduced a new picking method or policy for Hainan Island shoppers that took effect on February 2, 2021. The island shoppers can choose to receive their purchase goods via mail delivery, in addition to picking them up at designated ports. This applies for as long as the purchaser is also the receiver and payer of the goods. The purchaser or receiver should also send the delivery outside Hainan province.

Moreover, duty-free stores will deliver such purchased goods on a one-off basis after confirmation of requirements and the purchaser has left the island. As for the Hainan Island resident, they can pick up the goods after returning to the island provided that they can present their actual date of departure. The duty-free store may also deliver their goods given the island residents have met the requirements.

Hainan duty-free shopping centers

Foreign and domestic travelers must make the payments of duty-free items at offshore duty-free shops or approved online sales platforms. They can pick up their goods at the designated area of the airport, train station, or wharf.

Currently, the duty-free shops with qualification and authorization to sell tax-free goods can be found in the locations below.

- Haikou Meilan Airport

- Haikou Riyue Plaza

- Qionghai Bo’ao

- Sanya Haitang Bay

Hainan residents can also enjoy the new tax-free policy. Moreover, consumers must be over 16 years old and with valid identification documents including:

- ID card for domestic travelers

- A travel document for Hong Kong, Macao, and Taiwan’s travelers

- Passport for foreign travelers

Travelers must have already purchased tickets to leave Hainan island (via airplane, train, or ship) but not mainland China.

Other provisions included

The following related activities shall be punishable by law if committed by any of the travelers, duty-free shop operators, or involved parties:

- Reselling or smuggling of commodities from duty-free shops or engaging in procurement services;

- Violating customs supervision regulations;

- Assisting in violating the policy and disrupting market order (intended for travel agencies and transport companies); and

- Infringing relevant regulations in selling duty-free products (intended for offshore duty-free shops).

Individual consumers who are caught reselling or smuggling the tax-free goods will be banned from making future purchases for a period of three years. Meanwhile, any person committing a related crime will face investigation and obtain criminal punishment if proven guilty.

New tax regulation for offshore duty-free sellers in Hainan

On October 10, 2020, the STA released the order for offshore duty-free shops concerning tax declarations of VAT and consumption tax. According to Announcement No. 16, offshore duty-free shops must report or make tax declaration monthly. Furthermore, they should submit the following information to tax authorities when making the declaration for the first time:

- Basic information about operators of duty-free shops; and

- Relevant materials for the establishment of duty-free shops.

Duty-free shops that sell non-duty-free products (off the island) must pay tax and make tax declarations according to established rules. They are required to issue general invoices on VAT but are not allowed to issue special invoices on VAT for offshore duty-free products.

Duty-free product sellers whose license is revoked, or qualification has expired must report to the relevant authority 15 days after the date of revocation or expiration.

The new regulation for duty-free shops also require them to submit the following purchase-related information to tax authorities:

- Name and prices of the commodity; and

- Information of the traveler or purchaser of the duty-free product.

The tax bureau expects to implement the above rules for duty-free shops on November 1, 2020, and onward.

Conclusion

Based on the General Administration of Customs data, cosmetics purchased from duty-free shops earned the highest sales both in volume and profits. Furthermore, Hainan has reported an overall duty-free sale of RMB 1.9 billion in May 2020, better than the previous year.

Despite the COVID-19 impact on the tourism sector, Hainan has remained resilient due to its offshore duty-free shops that have become popular among the island’s tourists. According to a Forbes report, Hainan’s development potential is foreseeable, considering its advantage over Hong Kong in terms of size and population.

Contact us

If you are interested in doing business in China and want to know more, contact us to avail of our special services ranging from tax, accounting, financial advisory, company incorporation, and more.

Moreover, if you are already running your business in China, check out our latest technological solution that can improve transparency and efficiency in your company. Go to our Kwikdroid page to check the prices and packages we offer, no matter the size or type of company.