Recently, China’s State Council unveiled its masterplan for the establishment of the Hainan Free Trade Port by 2025. According to the report, the HFTP is expected to become “more mature” by the year 2035. HFTP will facilitate free flow of trade, business exchange and recruitment of high-end overseas talents between Hainan and the neighboring Southeast Asian countries.

Have a look at our previous article Hainan Economy Boosted with New Duty-free Policy

HFTP will also allow cooperation and joint development with the Guangdong-Hong Kong-Macao Greater Bay Area. Moreover, the grand plan includes the local and regional implementation of various preferential policies to attract foreign enterprises investment in the region.

Hainan Free Trade Port coverage

On June 10, 2021, China passed the HFTP law which will serve as a legal foundation for the construction of the HFTP. It aims to make HFTP a globally recognized free trade port by 2050. The new law will support development in many aspects including trade freedom, foreign investment access, high-level talent support, and construction of transportation hubs. Thus, it will provide new market opportunities for foreign investors and boost business confidence among market players.

1. Trade freedom

To facilitate free trade in the whole of Hainan Island, China will build a specialized area for customs supervision. Furthermore, the trade of goods and services will be liberalized and facilitated conveniently through zero tariff and easy access and operation, respectively. In more detail, the special customs supervision zone will consist of two lines of trade.

First line

The “first line” will allow import and export of goods freely from overseas into the Hainan Island. These, however, do not include goods that are within Hainan’s prohibitive and restrictive lists. Customs authorities shall develop a catalogue of import goods and exempt those that are not in the list from import tariffs.

Second line

On the other hand, the “second line” refers to the entry of goods from other Chinese regions into Hainan. If the goods entering Hainan do not contain imported items, or their value is more than 30 percent processed at the HFTP, tariff imports will be exempted through the second line.

Cross-border service trade

In terms of cross-border trade of services, Hainan will adopt a negative list system and implement a fund payment and transfer system. This way, foreign trade convenience will be achieved.

2. Foreign investment

HFTP Negative List for foreign investors

HFTP Negative List for cross-border service trade

A new Negative List (2021 version) took effect on August 26, 2021, concerning the provision of cross-border services into China. The list includes 70 items covering several industries including:

- Agriculture, fishery, animal husbandry, and fishery

- Construction

- Wholesale and retail

- Transportation, warehousing, and postal service

- Information, transmission, software, and information technology service

- Financial industry

- Leasing and business service

- Scientific research and technical service

- Education

- Health and social work

- Culture, sports, and entertainment

To find out more about the specific activities that fall under the Negative List for each of the industries mentioned above, check out the Special Administrative Measures for Cross-border Service Trade in Hainan Free Trade Port (Negative List) (2021 Edition) released by the Ministry of Commerce on July 23, 2021.

HFTP encouraged industries

The National Development and Reform Commission (NDRC) also announced the implementation of the Catalogue of Encouraged Industries in Hainan Free Trade Port.

On January 27, 2021, NDRC released newly added encouraged sectors consisting of two parts.

- Guiding Catalog for Industrial Restructuring (2019 Edition)

- Catalog of Encouraged Industry Sectors for Foreign Investment (2020 Edition)

The Catalogue includes 143 sub-sectors in 14 major sectors including manufacturing, construction, finance, leasing and commercial services, culture, sports, entertainment, etc. On the other hand, the finance sector lists the development of international energy, shipping, commodity, property rights, equity and other international spot trading exchanges, international spot clearing houses and international intellectual property exchanges, the development of two-way open service systems for cross-border investment and financing, and more.

The Catalogue has taken effect since January 1, 2020, and will continue until December 31, 2024. Moreover, these industries will benefit from the latest duty exemption policy covering Hainan Island.

Read more: Duty Exemption for Encouraged Industries in China

Further market access

Following the HFTP list of encouraged industries, NDRC also released special measures supporting five major sectors including medicine, culture, finance, education, and other key markets such as aerospace industry and satellite data applications and data sharing services.

3. HFTP enterprise income tax treatment

On June 23, 2021, the State Taxation Administration and the Ministry of Finance jointly announced three preferential tax policies for HFTP enterprises.

A 15 percent reduced enterprise (corporate) income tax (previously at 25 percent) for businesses involved in the encouraged industries. For enterprises to qualify for the reduced EIT, they must meet certain requirements including:

- Having a business activity that’s primarily in the encouraged industry;

- Earning 60 percent of the revenue from the said primary activity;

- Carrying out substantial business operations in the HFTP; and

- Tax exemption on foreign-source income of enterprises in the HFTP.

Enterprises with a foreign-source income from foreign branches can be exempted from income tax, including if they receive dividend income. This has been applied since January 1, 2020, and will expire on December 31, 2024. As per the dividend income, the enterprise taxpayer must hold 20 percent or more equity interest as a result of direct investment to be eligible for income tax exemption.

It can be noted that China’s tax bureau expects the foreign jurisdiction to impose a 5 percent statutory income tax on the foreign branch, given the eligibility for tax exemption.

Accelerated deductions of certain capital expenditures

Accelerated deductions refer to the enterprise fixed assets acquired from January 1, 2020, to December 31, 2024. However, this will depend on the value of assets. If the value of fixed assets amounts to RMB 5 million or less, an immediate deduction is allowed. On the other hand, if the value accounts for more than RMB 5 million, then accelerated depreciation or amortization can apply.

Find out Why Asset Depreciation is Important to Business Owners?

Three industries exempted from EIT under specified lists

- Tourism industry

- Modern service industry

- High-tech industry

4. Opening-up for high-end industrial talents

As HFTP is posed to be recognized internationally, the recruitment of high-end talents becomes a prerequisite. Thus, the government of Hainan also released policy measures in attracting high-end talents to work in the HFTP.

According to Measures for the Recognition of High-level Talents in Hainan Free Trade Port published on September 30, 2020, “high-quality talent” refers to any talents from Categories A, B, C, D, and E who meet the standards by HFTP for the Classification of High-quality Talents and are classified according to the standards for market recognition, professional community, and social determination. Moreover, each class category has an age limit ranging from 60-70 years old. A person to be identified as a high-quality talent shall be typically under the age of 60. However, the identification of talents of Category A may be relaxed to the age of 70 and 65 for Categories B and C.

The age limit may be appropriately relaxed for high-quality talents who are in urgent need or shortage.

Preferential tax treatment for high-end talents

High-end and urgently needed talents can enjoy preferential tax treatment on their individual income taxes (more than 15 percent waived). This tax policy is effective for four years (from January 1, 2020, to December 31, 2024). Moreover, they can obtain the exemption upon the IIT annual filing.

High-end talents (both local and overseas) will continue to enjoy the said preferential taxes given that they comply with the conditions set by the tax authorities.

- Recognized by the talent management department at all levels of Hainan province; and

- Within a tax year, the talent’s income in the HFTP reaches RMB 300,000 or more (subject to dynamic adjustment by Hainan province according to economic and social development).

List of shortage or urgently in need sectors

- Individuals from Hong Kong, Macao, and Taiwan operating in the Hainan Free Trade Port

- Technical backbone and management personnel in modern service industries, high‑tech, internet, and financial industries

5. Construction of transportation hubs

The full implementation of the HFTP will require the establishment of convenient transportation hubs and network systems for the exit and entry of goods. The HFTP will be designed to include land, aviation, and sea channels for international shipping and exchange. Thus, it envisions an integrated system of transportation as well as the development of innovative data connectivity.

Among the transportation hubs to be built include:

- International aviation hub

- New International Land-Sea Trade Corridor

- Yangpu International Registry Port

- Pilot zones for the cruise ship and yacht industry

- Hainan International Design Island

6. Further new development and improvements

HFTP will also dedicate a special pilot zone for medical tourism as part of the government’s risk and prevention control. Referred to as the “Boao Hope City”, this medical tourism pilot zone will consist of the following reform measures:

- Free and convenient trade-in licensed drugs and medical devices;

- Free and convenient investment;

- Free and convenient cross-border capital flow;

- Residence facilitation of foreign nationals;

- Creation of a “global franchise licensed drug insurance” in China and payment mode innovation for pharmaceutical insurance;

- A pilot program for clinical real-world data application and streamlining review and approval procedures including project constructions;

- A credit supervision system;

- An efficient online and offline work platform; and

Strengthened risk prevention and control.

On the other hand, the HFTP master plan also covers the establishment of an intellectual property court for the protection of IP rights among businesses.

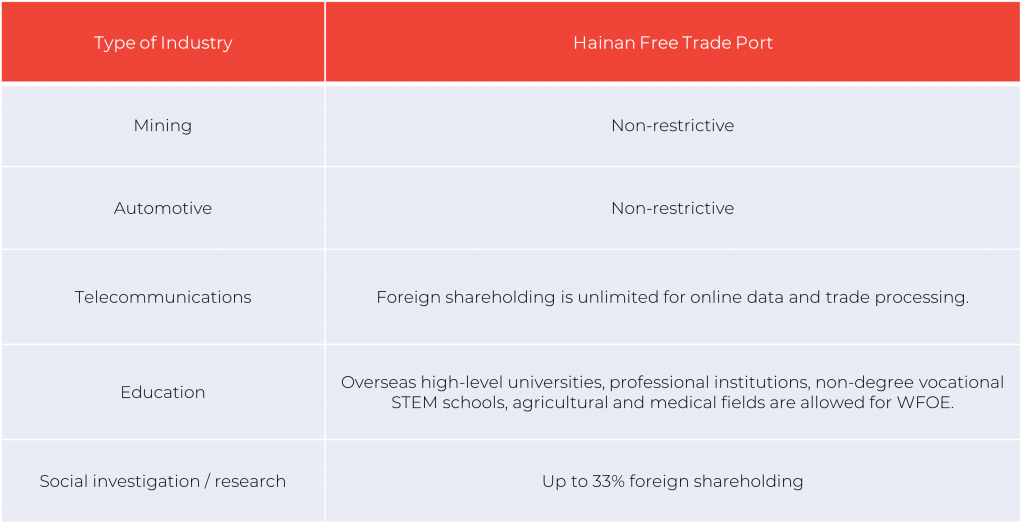

The HFTP implemented new market access for foreign investors from February 1, 2021. So-called the HTFP Negative List, it has removed or eased restrictions on various industries, making it easier for foreign investors to do business anywhere else in China.

Conclusion

China’s HFTP is indeed one of the country’s next big plans as it continues to be more inclusive and strengthen its international trade system. Hainan has the country’s largest free trade port and second-largest island that opens sea channels. It is poised to become an effective economic exchange zone with the Southeast Asian nations, and thus, intensify trade relations with these nations.

Contact Us

S.J. Grand provides advisory and support on the business set up as well as tax and accountancy services for foreign-invested companies in China. We assist foreign companies with tax optimization strategies to take advantage of China’s various preferential policies. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.