Rental expenses incurred by taxpayers fall within the scope of special itemized deductions in China. According to the special deduction policy under China’s new IIT law, the cost of housing can be deducted by both domestic and foreign nationals.

Have a look at our article about China’s IIT Special Itemized Deductions for 2019 announced

Recently, China has also planned to modify its property tax laws amid the growing housing prices. Keep reading to find out more details about rent deduction on your income tax.

Who is eligible for a tax deduction?

A resident taxpayer who has resided in China for 183 days in a tax year is eligible for a tax deduction on house rentals. To find out more details on the tax residency status according to the IIT reform law, please download our comprehensive report here.

What are some conditions?

Although the rent deduction also applies to legally married couples, there are some conditions in which the deductions can be allowable to make.

- No rent deduction will apply if one of them (husband or wife) has his or her own house in the city where either the husband or wife is mainly working.

- Only one taxpayer can apply for a tax deduction if the couple is working in the same city. If otherwise, each of them can apply for rent deduction.

- The couple cannot enjoy the special itemized deduction of housing loan interest and rent at the same time in a tax year.

What if you are an individual tenant?

The housing contract usually bears the name of the tenant. Therefore, the housing rental expenses will be deducted by the one who signs the contract. In the case of joint tenancy, only the person whose name is written in the contract can apply for individual income tax deductions on housing.

If both tenants’ names are written in the contract (except for legally married couples), each person can deduct a corresponding standard rent amount at the same time.

What is the standard rental amount?

Scope: It covers taxpayers who do not own their houses in the city where they are employed.

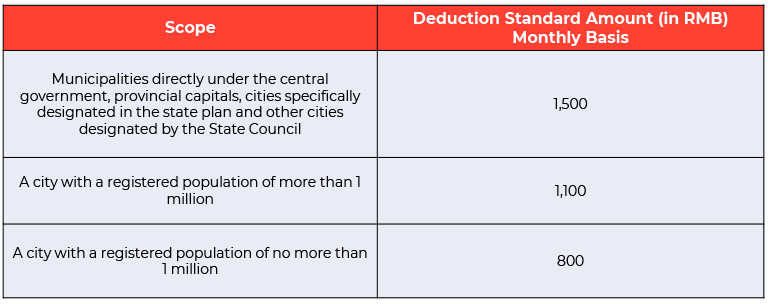

The table below shows the standard quota for housing deductions:

Taxpayers can apply for deductions of the housing rent before paying for their individual income taxes. Otherwise, they can apply for a tax refund.

How to apply for tax refunds?

To apply for a tax refund of unapplied tax deductions, the taxpayer undergoes annual accounting procedures for the year 2019. For resident taxpayers in China, they can also take advantage of the IIT Return app to make tax inquiries or get tax refunds. However, since the app may be difficult for foreigners to use, it is advisable to seek assistance from local advisory firms to go through the process.

Taxpayers under the following circumstances can apply for tax refunds:

- The individual paid taxes in advance and it is higher than the annual tax payable.

- The annual comprehensive income of the taxpayer is less than RMB60,000 in 2019, but he or she paid an individual income tax in advance during a normal period.

- The taxpayer was unable to declare qualified special additional deductions in 2019 after the advanced payment.

The processing time for a small tax refund request started from March 1 and will end on May 31, 2020.

Check out how to use the tax App in our previous article: IIT Return App for Taxpayers in China

Housing reduction for enterprises

Due to the COVID-19 outbreak, small and medium-sized enterprises got to benefit from housing fees reduction. For example, in Shanghai, enterprises renting state-owned offices are exempted from the rent for two months (February and March).

Furthermore, the Chinese government has imposed deferred payment policy on social insurances including housing.

Read our previous post on Social Insurance Cuts to Help Small Enterprises in China

Property taxes in China

Following the Interim Regulations of the People’s Republic of China on Property Tax, property taxes in China are paid by the property owner.

According to Article 4 of the provision, the tax rate on the residual value of the property is 1.2% and 12% on the rental income of the property. Furthermore, the following properties are exempted from paying real estate taxes:

- Self-use by state organs, people ‘s organizations, and the army

- Personal use by units financed by the state finance department

- Religious temples, parks, and historic sites

- Individually owned non-business properties

- Other properties exempted from taxation with the approval of the Ministry of Finance

Meanwhile, Shanghai, Hangzhou, and Chongqing are the first pilot cities for this updated policy.

Shanghai property tax

In Shanghai, the rate of property tax is 70 percent of the transaction price of the taxable housing in the market. The market price of taxable housing is determined through evaluation. In general, the applicable tax rate of the property is 0.6 percent. However, the rate can be reduced to 0.4 percent. This applies when the market value of the taxable housing per square is lower than the average sales price of the newly-built commercial housing of the city.

Moreover, tax relief may be granted to non-residents by exempting them from the property taxes temporarily.

Qualifications:

- High-level talents and key industries under shortage and urgency; hold a work and resident permit; have newly purchased housing in Shanghai;

- Those with a residence permit for 3 years and have newly purchased housing in the city;

- Non-residents with a 3-year residence permit but have lived in Shanghai for less than 3 years can get a refund on housing taxes after the period of residence.

If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!