There was a time when only big companies and SMEs facing difficult seasons would consider consulting with or hiring an accountant. Hiring an accountant seemed to be an unnecessary expense that some companies disregarded to cut costs. But not all savings are worthwhile. Even the role of an accountant is detrimental to the success of a CFO’s (chief financial officer) function in business performance.

See our previous article on The Role of the CFO in Business Performance

Nowadays, accountants play a crucial role in the success of resilient companies who waded through the river such as the COVID-19 crisis. Accountants can give expert advice about different financial and economic aspects for business survival. But more so, they also espouse the qualities that are useful in the age of the “new normal”. Read on to find out more!

What is the role of an accountant?

An accountant is a professional who practices expertise in account analysis, auditing, financial statement analysis, and other accounting functions. Being a finance professional, an accountant is in-charge of either public or private accounts of individuals and/or companies of any size.

To be able to fulfill his or her duties, the accountant must acquire important skills to perform various essential functions such as:

- Account analysis;

- Ensuring the accuracy and reliability of financial documents or reports.

In other words, accountants speak the language of business. They may not be directly money-generating in most industries (unless perhaps if you’re in the accounting industry) as the sales department. However, they do make sure that the company can keep its money and spend it properly.

4 characteristics of an accountant

1. Learned in the ways of money

Typically, an associate degree or even a vocational certificate may suffice to earn a job as an accountant (bookkeeper is interchangeably used at times). For some companies, having a master’s and doctorate degree earns you a place in higher positions up their corporate ladders. In any given position, being an accountant means being able to gather financial information. Not just that, it also entails interpreting and analyzing it for decision-makers of a company.

The knowledge of an accountant does not come overnight; months or years of studying, training, and learning are invested to acquire a solid foundation in business studies. Therefore, accountants first understand the basic functions of a business for them to accurately analyze and interpret financial data.

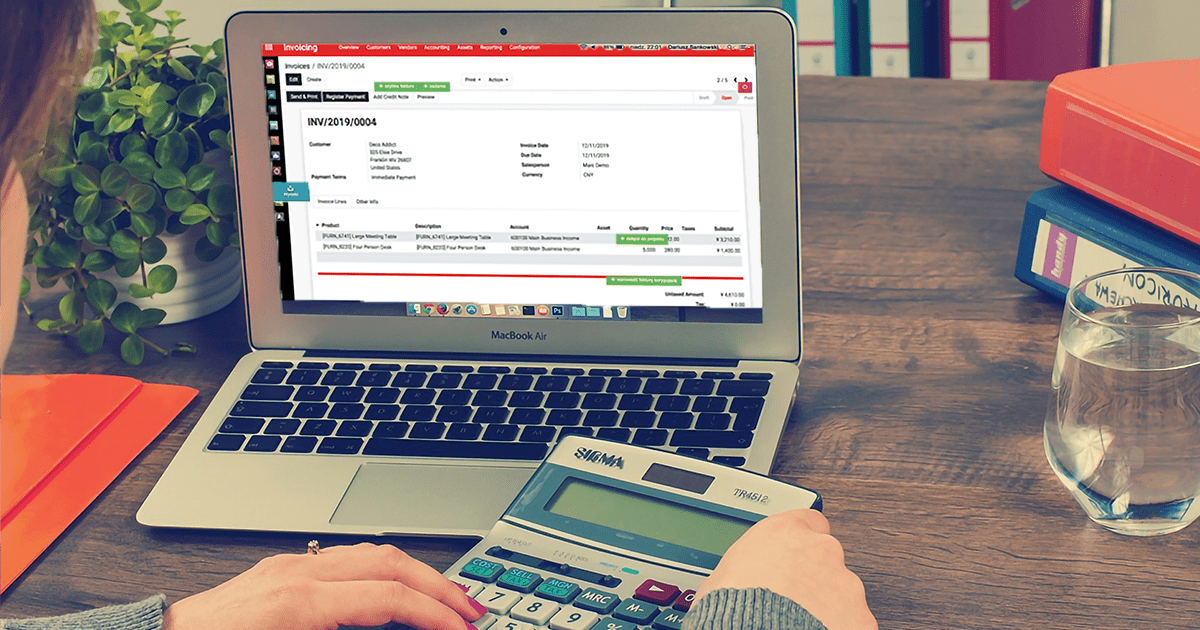

2. Knows the way around a computer

Gone are the days of the abacus and manual computing, or even paper spreadsheets. A business owner has to know at least the basic features of an excel spreadsheet. However, an accountant knows how to make that spreadsheet, spot errors, extract data, and anything that goes with it.

The challenge?

Accounting software, Cloud-based systems, and other technology-related systems that help in financial decision-making are important must-have tools for an accountant’s daily work. But those who cannot keep up may become obsolete and a change of profession might be an arm’s length transaction away.

Get further insights on How Cloud and AI are Transforming Accounting

3. Detail-oriented and organized

“Once you start down the dark path, forever will it dominate your destiny. Consume you, it will.” -Yoda, Star Wars

A dark path for accountants could be the hordes of data they have to sift through to get viable information. Accountants need to be able to sort through bulks of data without being confused by it all. They know how to prepare this bulk of data as well; once they do, they would also know how to check others’ works too. This is how auditors spot errors: by being able to go through data and by knowing how to do what they are checking. Once auditors spot these errors, no matter how they are hidden under mountains of other information, the audit trail will lead them to it if they know where to look.

Errors, fraud, and other irregularities are the fruits of an auditors’ labor; whereas these are an accountant’s bane.

4. Client-oriented and remote-work reliable

Despite having to work with money daily, accountants seldom handle cold, hard cash. Receipts, invoices, bills, transaction notices, bank statements, etc.: these are the representations of money in the form of revenues and expenses that accountants handle. With computer vision technology, even information in these physical documents can be transferred reliably to the Cloud.

Have a look at our previous article on Integrating Computer Vision into Accounting

Working remotely with your accountants will not be a problem, given the right technology. Reliability is still a priority and should not be compromised in social distancing situations. With the proper tools and software, accountants are there to help run your business properly and stay safe at the same time.

At last, an accountant’s first priority professionally would be the clients. Thus, accounting’s new normal dictates that accountants should be able to cater to their client’s needs in the most accurate way without compromising safety.

Kwikdroid – an accountant’s effective companion

Kwikdroid is an accounting and management solution in one. It is a cloud-based platform that is fully compliant with Chinese regulations. If utilized properly, business owners, whether foreign and local alike, may be able to control and oversee their businesses remotely.

Your accountant plus Kwikdroid

Although Kwkdroid is an accounting solution with AI and OCR technology to boot, wouldn’t it be even more useful if you had an accountant in-house? Kwikdroid has a solution to that! With an option that lets you contact your S.J. Grand certified accountant, it’s like having your accountant at the table right next to you.

Our accounting team’s expertise in the system and financial applications of daily business needs and transactions will also be at your fingertips. Conveniently and reliably contact your accountant (and staff) in the context of the “new normal”. Hence, using Kwikdroid lessens the risk of contracting COVID-19 while making sure that your financial accounts are in order.

Conclusion

COVID-19 has proven how indispensable the accountants’ role is. Their versatility in the business world, their skill sets, and professional knowledge will help business owners rise above the challenges faced in the era of the “new normal”. No matter where you are in the world, your accountant may be able to help you keep your business in running condition. With the proper technology and team behind your business, you can course through the difficult times faced by everyone in the world today.

Contact us

S.J. Grand specializes in addressing your tax or accounting concerns and helping your business weather the test of times. Contact us to avail of our special services.

If you are interested to learn more about our latest Cloud-based company solution, go to our Kwikdroid page to check the prices and packages we offer, no matter the size or type of company.