When importing goods into China or exporting them out of China, very specific taxes and duties may apply. Make sure to know exactly how this taxation and duty system works before starting your import / export business in China.

Have you read our previous article? China To Launch 6 New Pilot Free Trade Zones

There are three different kinds of taxes and duties that apply when importing / exporting to China:

- Consumption tax for imported goods

- Customs duties

- Value Added Tax (VAT)

Consumption tax for imported goods

This tax concerns only goods that are considered harmful to health, such as alcohol, tobacco, luxury goods, cars, motorcycles, cosmetics, fireworks, etc.

The applicable rates depend on the value or the quantity of the goods imported.

Customs duties

Calculation methods

- Ad valorem duty = Customs Value × Rate. The customs value is usually the price paid by the importer, including insurance and transportation costs before unloading.

- Specific duty = Quantity of Goods × Unit Duty

Import duties

When importing goods to China, the products have first to go through customs and customs duties have to be paid. There are 6 distinctive situations where different rates may apply.

General duty rates

They are the standard rates that apply if no specific agreement or treaty has been signed between China and the country of origin of the imported goods, or if the origin of the products is not known.

Most-favored-nation (MFN) duty rates

These rates concern goods imported to China and originating from:

- A WTO member country

- China

- Countries that have signed a bilateral trade agreement on reciprocal MFN practices with China

They are lower than the general duty rates.

Conventional duty rates

They apply to the import of goods originally coming from a country that signed regional trade agreements with China comprising preferential duty clauses. These preferential duty rates are generally lower than the MFN rates.

Note: A zero-tax rate applies to all products originating from Hong-Kong and Macao.

Special preferential duty rates

In this case, China and the goods’ country of origin have an agreement comprising clauses on special preferential duty rates. They are generally lower than all the above-mentioned rates.

Tariff rate quota (TRQ) duty rates

Some goods are subject to tariff rate administration. If you import a quantity of these goods that falls within the tariff quota, then TRQ duty rates apply. If the imported quantity exceeds the tariff quota, one of the above higher duty rates apply.

Temporary duty rates

Sometimes, such rates are implemented to support some industries or boost parts of the economy. Regarding these duty rates, there are 3 special situations:

- If an imported good is concerned by temporary duty rates and MFN rates, the temporary duty rates prevail.

- If there are temporary duty rates and conventional duty rates for a given imported good, the lowest duty rate applies.

- When a good is subject to general duty rates, the temporary duty rates don’t apply.

Export duties

Temporary duty rates may apply for a limited time.

Exemptions from customs duties

Some goods may be exempted from customs duties in China, such as:

- Goods on which duties would not exceed RMB 50

- Promotional material and samples that have no commercial value

- Materials and goods provided free of charge by foreign governments or international organizations

Temporary import/export

If you import goods only temporarily into China, you may request a duty-free temporary import for the following purposes:

- Goods issued or used at fairs, exhibitions, meetings or similar events.

- Goods used for sports or cultural events or competitions,

- Equipment for press, cinematography or television

- Equipment for scientific, educational or medical activities

- Means of transport for the above-mentioned items

- Commercial samples

- Tools used for the installation, testing and adjusting of equipment

- Containers

- Other goods with non-commercial purposes

However, a cash deposit is required, amounting the duties payable. Furthermore, the goods have to be re-exported or re-imported in the next 6 months after arrival or departure. Though, it is possible to request an extension of this time limit to a maximum of one year. After re-exportation or re-importation, the deposit will be returned.

For information about the declaration and payment of customs duties, you may read the Regulations of the People’s Republic of China on Import and Export Duties .

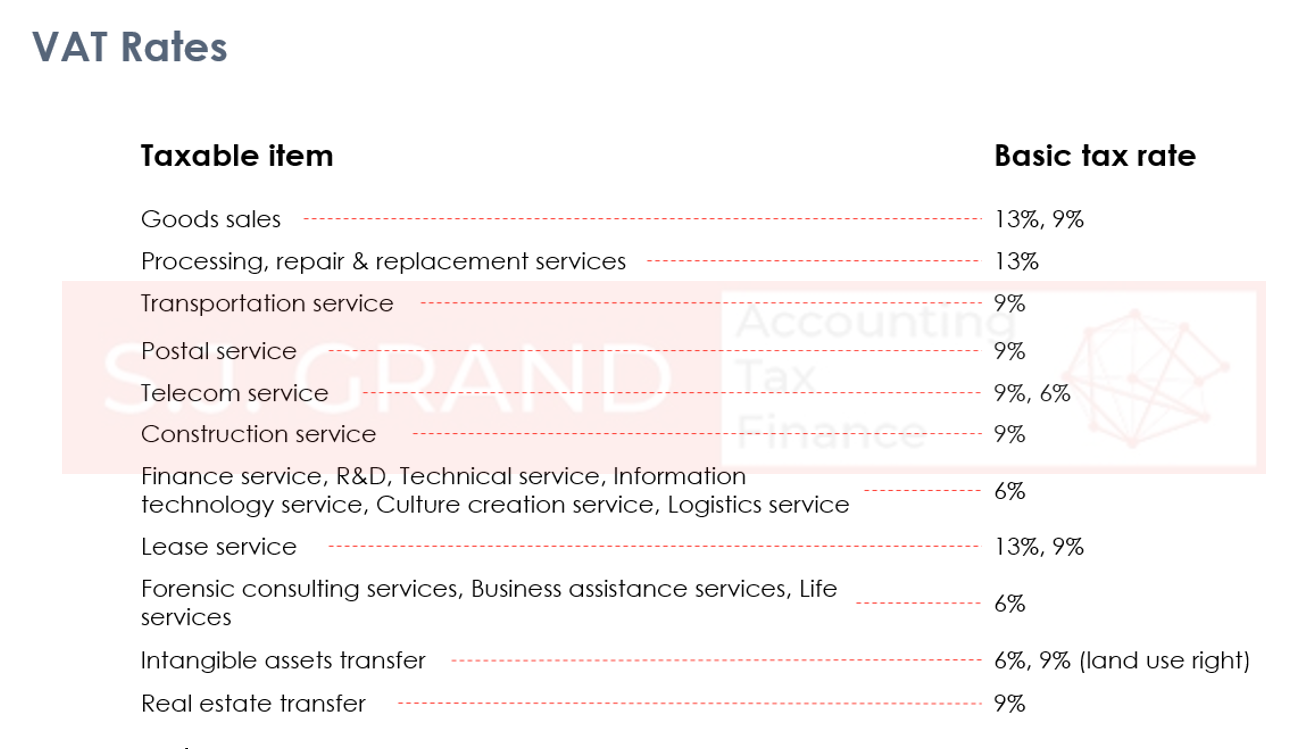

VAT

Import VAT

Companies importing goods into China will have to pay a so-called import VAT. The VAT rates vary depending on the type of goods but are generally 13% or 9%.

Import VAT = [Price of goods + customs duty + consumption tax] x VAT Rate

When the goods are sold on the Chinese market, the company receives output VAT from its customers which can partially or totally offset the company’s input VAT.

Output VAT = Sales x VAT rate

Export: VAT rebates

Before exporting, the company purchased goods in China and therefore paid input VAT that was included in the price. Then, VAT rebates are granted when the company exports goods from China. There are two cases to consider here.

If you are a trading or another non-manufacturing company in China

In that case, the ER (Exemption-Refund) system applies. This means that you won’t be able to withhold output VAT on the goods you sell outside of China. You may only get a refund from the Chinese government for the input VAT incurred. However, this refund does not always cover the whole input VAT, which may therefore leave you with an added tax burden.

If you are a manufacturing company in China

This time, your company follows the ECR (Exemption-Credit-Refund) system. The exemption works exactly like previously. The difference lies in the possibility for you to offset your input VAT by selling a part of your products to domestic customers and therefore receiving output VAT from them. If this is not enough to totally offset your input VAT, the government will compensate the difference. On the other hand, if the output VAT you received exceeds your input VAT, you will have to pay the excess to the Chinese government.Do you need help for you importing / exporting business in China? Get in touch with our team for a consultation and follow us on social media to receive the latest news.

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

Also, don’t forget to follow us on social media to receive all the latest updates!

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!