Income tax declaration is an important obligation of every individual earner. In China, the individual income derived from China and overseas are taxable under the country’s tax policy. Hence, taxpayers are required to conduct self-declaration or self-reporting of their comprehensive income according to China’s IIT law.

Read our previous article on China’s IIT Law Withholding Measures for 2019 Released

The rules in China regarding tax declaration depends on different cases. Especially, the taxpayers are categorized based on their tax residency status – whether resident or non-resident. This article will guide you through the specific rules on declaring your taxable income.

Who may be required to declare individual income tax?

1. Taxpayers with an annual income of RMB 120,000 need to declare within 3 months after the end of the tax year. These include:

- Individuals having no domicile in China;

- Individuals who have resided in China for 183 days or less.

2. Taxpayers with a foreign income need to declare within 30 days after the tax year ends. These include:

- Individuals with either domicile or non-domicile status but have a residence in China for 183 days or less (or one tax year).

3. Taxpayers with two or more sources of income (wages and salaries) in China need to declare within 15 days of the next month. These include:

- Individuals who obtain taxable income;

- With no withholding agent;

- Any other circumstances required by the State Council.

4. Taxpayers with equities transferred to any other individual or entity need to declare within 15 days of the following month.

5. Taxpayers with income from the transfer of restricted stock must also declare.

6. Taxpayers with investments on personal non-monetary assets should conduct annual filing and payment of IIT within the deadline or tax payment limits agreed upon.

On the individual income tax from restricted stock transfer

The tax settlement for restricted stock transfer is pre-withheld and prepared by securities institutions. It should be handled within 3 months as of the first day of the following month. On the other hand, taxpayers who adopt self-declaration will have to report their IIT income on the transfer within the first 15 days of the next month.

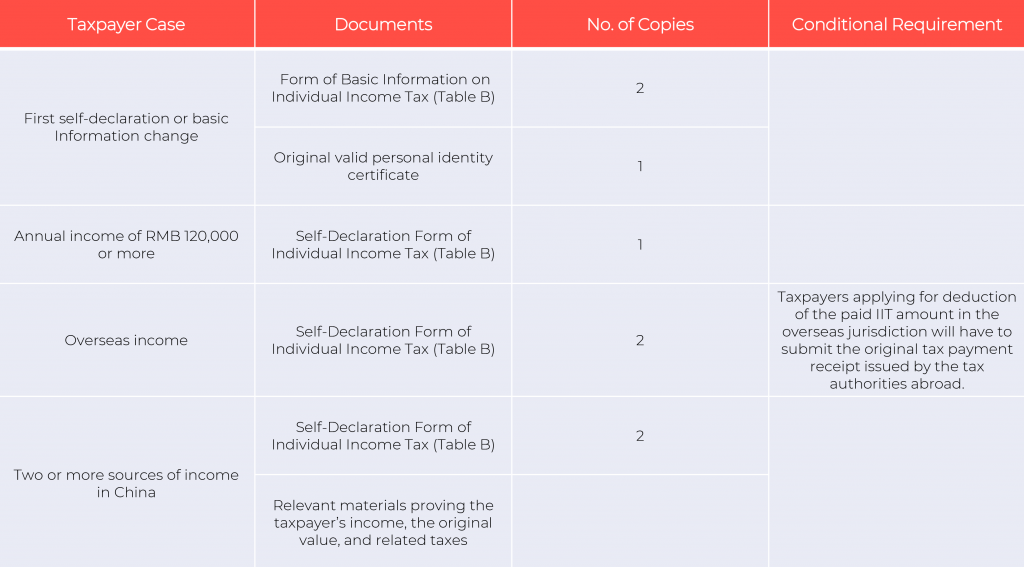

Required materials for self-declaration

Equity transfer to another entity

- 2 copies of the Self-Declaration Form of Individual Income Tax (Table 4)

- A copy of the equity transfer contract

Conditional requirement:

- If asset evaluation is required, submit an asset value assessment report on net assets or land and real estate issued by a qualified intermediary.

- If the tax base is low, proof of corresponding materials is needed.

- If benefited from deferred tax payment policies for equity incentives and technology investments, submit proof of transfer price and the original value of the stock for deferred tax payment.

Transfer of restricted stock

Case 1: Taxpayers whose IIT are levied through pre-withholding and prepayment by securities institutions

- 2 copies of the Form for Filing Settlement of Individual Income Tax on the Income from the Transfer of Restricted Stocks

- A copy of records of restricted stock transactions bearing the seal of the securities institution

- A copy of tax payment voucher (exclusively used for the Tax Authority Custodian Fund or the Transfer of Tax payment

- A copy of relevant vouchers for the original value of the property

Conditional requirement:

If the taxpayer authorizes a representative to do the tax declaration, the following documents are needed:

- The original ID of the representative;

- Power of attorney with the authorization statement.

Case 2: Taxpayers who opted to self-declare

- 2 copies of the Form for Filing Settlement of Individual Income Tax on the Income from the Transfer of Restricted Stocks

Investments with personal non-monetary assets

- A copy of the Form of Individual Income Tax by installments on investments with personal non-monetary assets

- A copy of IIT payment certificate of the said installments

- 2 copies of the Self-declaration of Individual Income Tax

Taxpayers under other circumstances or required by the tax authorities

Taxpayers who have taken advantage of the IIT pilot program and deferred payment of taxes for commercial health insurance need to submit the following:

- A copy of the detailed statement on the pre-tax deductions of commercial health insurance and tax-deferred

Taxpayers who are entitled to tax reduction and exemption need to present the following:

- A copy of the Report Form for matters regarding tax reduction and the exemption

Contact us

Our team of local and foreign experts can assist your business in matters regarding your individual income tax filing. Moreover, you can take advantage of our easy-to-use, 24-hour access management tool like Kwikdroid.

Kwikdroid is a Cloud-based accounting and company solution that allows your company to standardize your business operations. It helps you generate electronic invoices by scanning your fapiao with OCR technology and automatically uploading them into one single storage.

S.J. Grand also offers Cloud ERP services for your business if you are currently experiencing difficulty in managing your operations amid the COVID-19 pandemic. Check out our IT services page for more details.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.