From July 1, 2021, the European Commission has started implementing a new VAT rule for e-commerce within the European Union (EU) states. The changes in the application of VAT rules will affect both established and non-established EU companies as well as those sellers or suppliers from outside the EU.

Have a look at our previous article on Currency Swap Deal between Europe and China

What does the new EU VAT reform mean for traders outside the EU? How are the rules adjusted and what important reminders are there for EU enterprises involved in the online commerce industry? Find out!

What is the new rule for EU VAT all about?

The new rules on VAT that took effect as of July 1, 2021, apply to business-to-customer transactions (B2C) such that suppliers or sellers of goods and services, marketplaces, and postal couriers will be impacted.

Previously, imported goods from non-EU countries with a value less than 22 euros are exempted from VAT. The new rule, however, abolishes this exemption. The reason behind this is to ensure that there is fair competition among suppliers to the EU.

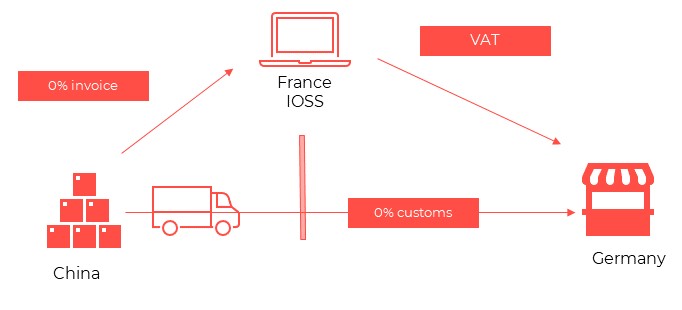

Instead, non-EU suppliers will apply to a new report scheme covering their sales of imported goods (consignments) to EU consumers up to a value of 150 euros. Moreover, they can avail of import VAT exemption if they declare and pay the VAT at the time of sales through the Import One-Stop-Shop or IOSS system.

On a positive note, non-EU suppliers or sellers can optimize VAT application and registration as they won’t need to do so in every single member state.

One-Stop-Shop declarative system

According to the new rule, non-EU online sellers can register through the OSS system as “non-Union” taxpayers (to obtain MSI or Member State Identification). They must do so with the tax jurisdiction of their choice. This means that they can choose to which EU member state to register and file their quarterly returns. However, they would need to file a regular domestic VAT return in at least one EU member state. On the other hand, non-EU sellers cannot choose their registration state where they have a fixed establishment in the EU.

The OSS or IOSS is established to enable a simplified and uniform system for all VAT payers of traded goods and services, including those outside the EU. A more detailed guide to the OSS system can be found here.

Implications of the IOSS

The removal of VAT exemption on importation makes the IOSS a critical factor for VAT payments. After registration through the IOSS, the goods imported will reflect the final price to the consumers, meaning that there will be no hidden charges or fees as VAT is already included.

However, if sellers do not register through the IOSS, the consumer will pay for the VAT upon the import of goods in the EU. Moreover, users of postal services may also have to pay an additional clearance fee for VAT collection purposes.

Overall, the IOSS system will aid in a quick release of the goods by EU customs authorities and therefore, enable a swifter delivery to buyers.

Electronic interface: trading on a marketplace, platforms, portals, and others

With the electronic interface VAT rule, a non-EU established seller facilitates the sales of distance goods to buyers in the EU and is also liable for VAT payment (i.e. goods from China imported in one EU state and then, shipped to a buyer EU state). At the same time, the electronic interface must also register via IOSS at the import EU state to declare and pay VAT to the buyer state. As the goods arrive in the buyer state, therefore, the non-EU established seller will be exempted from VAT import.

An electronic interface is liable for VAT once the buyer and seller enter a contract for the sales of goods to the buyer. The actual seller is not established in the EU; thus, the electronic interface facilitates the sales transactions.

The new threshold under the EU VAT rule

VAT application on cross-border sales normally follows a threshold that all traders must be aware of. Previously, the EU’s threshold amounted to 35,000-100,000 euros depending on the member state.

The newly implemented VAT rule, however, has changed this threshold to 10,000 euros. Therefore, for sales above this threshold, traders will have a VAT liability to the member state they are registered with, or where their consumers are located.

However, the new threshold of supply does not apply to imported goods or distance sales of goods as it is only required for sellers established in any single EU member state.

Conclusion

With the new rules, non-EU-based businesses that trade goods and services into the EU may have to appoint an intermediary person. This means that the intermediary taxable person based in the EU will perform the VAT-related procedures on their behalf. But this does not apply if the non-EU country has concluded an agreement on mutual assistance for the recovery of VAT with the EU. Furthermore, companies involved in e-commerce must prepare their sales and shipping processes amid the implementation of the new EU VAT rule, especially for the IOSS users.

The new VAT rule applied in the EU is expected to put all traders (European and foreign) on an equal footing in the market. It also aims to re-establish fairness between e-commerce and traditional shops.

Contact us

S.J. Grand provides advisory and support on the business set up as well as tax and accountancy services for foreign-invested companies in China. We assist foreign companies with tax optimization strategies to take advantage of China’s various preferential policies. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!