COVID-19 is an unprecedented crisis. It has caused confusion, diminished workforce, and decreased face-to-face interactions. Although everybody has suffered in different ways, fraudsters are taking advantage of this and may even succeed if business owners are not careful.

Read our previous article on Fraud Triangle and COVID-19: What to Watch Out for

Fraudsters can successfully victimize businesses that are unaware of how fraud takes place, especially within the company. However, there are ways to “spot and stop” fraud from happening. Knowing the intricacies of these fraud schemes will help you achieve this purpose.

Find out the 4 Ws and 1 H of Supplier Payment Fraud:

- What is supplier payment fraud?

- Who commits the fraud and who are the victims?

- When have they been most active?

- Why do they commit fraud?

- How to spot and stop them?

Supplier payment fraud

The usual case of supplier payment fraud may come in the form of unsuspecting companies. Such companies will have undelivered legitimate claims due to payments being diverted to other fictitious companies. As simple as a mere e-mail can cost a company millions. For instance, ABC Company purchases goods amounting to RMB 10,000 from XYZ Company, and the goods were delivered. The purchasing office of ABC Company gets an e-mail telling them to make the check payable to XXX Company. Without confirming this with its supplier, ABC Company makes the payment. Only if XYZ Company reminds their customers of outstanding balances will ABC Company know that they were defrauded.

Now imagine this scenario happening to real-world companies, with amounts reaching millions of dollars’ worth of companies’ money. These days, payment through bank transfers are more convenient, which makes fraudsters’ jobs easier as well.

Fraudsters

Fraudsters may be from within the company or those outside of it. They can range from your most trusted managers, people in authority, people with access, your staff, customers, or random people who wish you harm. In terms of supplier payment fraud, the victims are both the supplier who did not receive what is due to them, and the company who paid a fictitious or fraudulent company. The perpetrators may range from outsiders who merely had access to the e-mail of the paying company and manage to divert payment to them instead of the payee.

Fraudulent activities

Business E-mail Compromise (BEC) is a scam scheme targeting companies who conduct wire transfers and have suppliers abroad. From April to May 2020, BEC attacks focused on invoice or payment fraud increased by 200 percent. Interestingly, this is the period when COVID-19 has slowed down in China but has sped up elsewhere in the world.

Fraudsters can impersonate vendors, suppliers, or customers to redirect vendor payments. The confusion that COVID-19 has caused, that is, questions such as “Will I get the virus?”, “Do I still have a job/business after this lockdown?”, “How do I know if I really am safe now or in the future?”, etc., has caused the majority of the world in a panic; and fraudsters are taking advantage of this.

The rationalization behind the act of fraud

Justifying fraud may come in different ways, but just a famous actress once said “Just because you can, doesn’t mean you should”. Just because fraudsters can get away with their actions, they do it for the sake of doing it.

Identifying supplier payment fraud

Where fraudulent insiders are involved, they may be able to incorporate fictitious vendors to your master list and divert payments there. Moreover, stale accounts might also be taken advantage of by sending the paying company invoices for outstanding purchase orders that have not been followed up by vendors, having previously taken it upon themselves to arrange for the bank account to be redirected to them instead.

On the other hand, another variant might involve the fraudster sending legitimate-looking e-mails or other correspondence that will ultimately divert or redirect payments away from your rightful supplier. Aside from e-mails and other written correspondence, personal phone calls might be utilized to commit fraud. Sensitive information such as changes in bank accounts or addresses might be involved in that fraudulent call. Another common example would be fake invoices sent to companies in the hopes of escaping detailed scrutiny.

Victim companies’ unsuspecting payables officers might simply create a vendor for that invoice without checking with the purchasing department, so that invoice can be paid. In summary, they can be referred to as:

- Fictitious vendors in the vendor list;

- Stale outstanding vendor claims;

- Fictitious e-mails and other correspondence;

- Phone calls asking for a change in the bank account or address;

- Fictitious/non-existing invoices that get past scrutiny.

Vigilance is key in preventing your company from succumbing to payment fraud schemes and fighting corporate fraud; although it is a risk none of the business owners can truly eliminate (unless all fraudsters in the world simply vanish). Minimize risks from your business by tightening security, maintaining checks and balances, and ensuring you have a reliable and convenient system your company can rely upon.

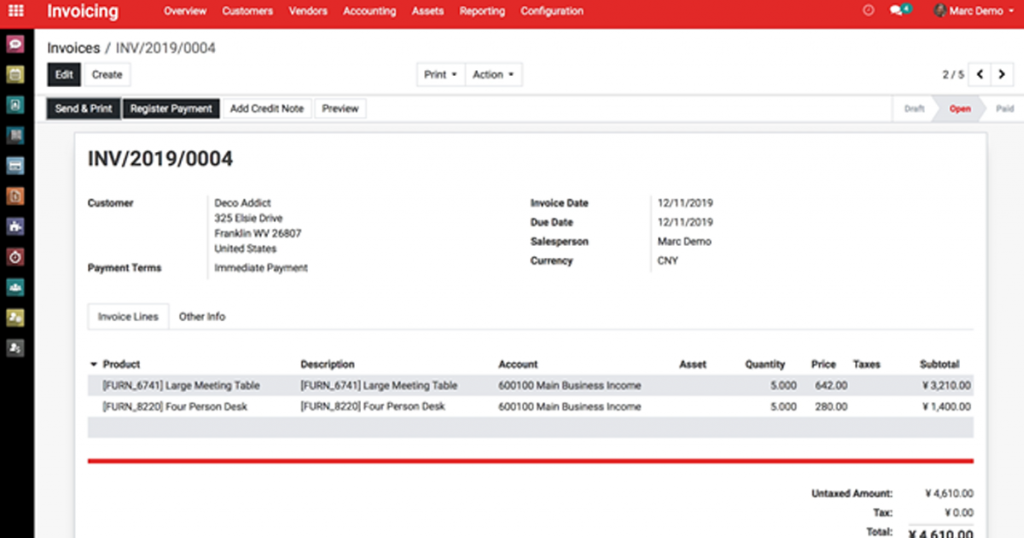

How to prevent supplier payment fraud with Kwikdroid

Managing the vendor list is among the many features of Kwikdroid. Vendors abroad may have accounts in different currencies since the Cloud-based platform supports multi-currencies and multi-languages. Furthermore, Kwikdroid can automate important supplier-vendor functions and will let you know every time a new vendor is added. Since everything can be accessible anywhere and anytime, business owners can be fully aware of every transaction that is going on inside the company. And that’s what Kwikdroid does. It gives you full control and transparency over your business operations. See Kwikdroid’s invoicing features below.

Also, by having a direct line with your S.J. Grand accountant, your business will have quick access as to the correctness of your transaction inputs. S.J. Grand offers Risk Management services that focus on risk analysis of strategic accounting and tax issues, implementing risk management solutions into business planning, assessing operations and investment opportunities through cost-benefit analysis, and developing ongoing risk-monitoring processes.

Conclusion

Supplier payment fraud is not a risk one completely removes but can be easily managed. With the right information, system, and professional support, one need not succumb to such schemes. No matter what form fraudsters may wish to take, your company can be prepared without having to learn the hard way.

Contact us

S.J. Grand’s financial advisory service provides due diligence, risk management, and forensic accounting for your business. Furthermore, we utilize state-of-the-art technology, Kwikdroid, that assists in automating several functions in one secured Cloud database. Contact us to get you started.

If you want to know more about our latest Cloud-based company solution, go to our Kwikdroid page to check the prices and packages we offer, no matter the size or type of company.