Cross-border payments for non-trading business items such as dividends, interests, royalties, and service fees may be taxable under China’s law. Thus, such payments made to overseas entities may carry income tax and VAT charges unless a tax treaty is applied.

Have a look at our previous article on Double Taxation Relief for Foreigners in China

What are the withholding tax procedures for non-trading overseas payments? What are the conditions for enjoying tax exemption or reduction under tax treaties? Read more.

What belongs to non-trading, cross-border payments?

Dividend: It is the portion of profits paid and distributed to overseas shareholders. You can find more about how and when it is allowed to distribute your dividends in our previous article: Dividend Distribution to Foreign Shareholders

Interest: This includes leasing payments or loans from lending or borrowing funds. It is called an interest income when a company in China lends funds to entities outside China. On the other hand, it is an interest expense for the cost of borrowing funds from outside China such as financial institutions, banks, bond investors, or other lenders.

Royalties: These are fees paid for the use of intellectual property, such as trademarks, patents, copyrights, and proprietary technology. Royalty remittance is one of the ways in which foreign companies with subsidiaries in China can repatriate cash from their subsidiaries if not sending them via dividends. Sending royalty payments may be cost-saving for enterprises because it may be exempt from paying corporate income tax with a flat rate of 25 percent.

Service fees: These are fees paid for services rendered inside or outside China that may or may not be taxable. They also depend on the type of services. Examples of these services are rendered for consulting, design, management, or other labor services.

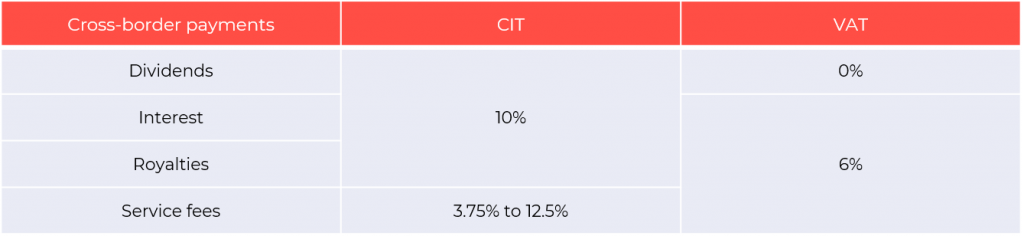

Tax treatment for cross-border payments

Cross-border payments to entities outside China may have CIT or VAT impact in terms of withholding taxes depending on some criteria. Moreover, some taxes may not be applicable under a tax treaty. Nevertheless, the tax treaties between China and other countries may also vary so different tax rates may apply. Meanwhile, individuals or organizations can apply the double taxation agreement of China with other countries when selling a company.

Read more: Tax Implications of Selling Your Company in China

The following are the tax treatments for the non-trading payments:

As for dividends, interest, and royalties, the CIT rate may reduce through a tax treaty application which varies according to country jurisdiction. Moreover, a non-tax resident individual or company should meet the conditions of a “beneficiary” owner in order to take full advantage of the tax treaty preferential rates. Foreign individuals who receive dividends from WFOE or JV may be tax-exempt depending on a case to cases basis. To note, domiciled individuals are normally taxed at a flat rate of 20 percent.

Service fees category

Service fees rendered outside China are not taxable with CIT, however, authorities will require certain documentation proving that the service is fully rendered outside China. Otherwise, services rendered fully or partially inside China will be taxable based on deemed profit rate ranging from 15 percent to 50 percent depending on the nature of the service as follows:

- For those engaged in contracted project operations, design, and consulting services, the profit rate is 15%-30%;

- For those engaged in management services, the profit rate is 30%-50%;

- The profit rate shall not be less than 15% for other labor services or business activities other than labor services

In terms of VAT, local tax rates may apply for withholding tax. For example, Shanghai charges 12 percent local taxes based on the VAT paid for service fees. Furthermore, VAT impact on services fees and royalties can be deductible by the withholders so long as they are general taxpayers (GTP) and the expense is within their normal operation scope.

Have a look at our recently published article on VAT payers: VAT Payers in China: Small vs. General Taxpayers

What are the conditions for the beneficiary owner?

The beneficiary owner is used as a condition for tax treaty application in China. It refers to the person who owns or controls the rights or property from which an income is derived. According to the interpretation of China’s State Taxation Administration Notice No. 9 on the issues related to “beneficiary owners” in tax treaties, there are five negative factors to consider in determining the beneficiary owner.

The applicant for the beneficiary owner should meet the following conditions to qualify:

- Under obligation, the applicant pays more than 50 percent of the income to residents of a third country (region) within 12 months of receiving the income;

- The applicant is not involved in any substantive business activities such as substantive manufacturing, distribution, and management activities;

- The applicant is exempt from tax on the relevant income or the tax on the income is not taxable in the country jurisdiction. If the income is taxable, the tax should have a very low charge rate;

- In terms of loan agreement where interest is paid, the creditor must have the loan or credit agreement with a third party containing the same principal amount, interest rate, and signing date;

- As per royalty payments (copyright, pattern, or technology licensing agreements), a relationship or agreement must exist between the non-resident and a third party relating to the transfer of ownership, right to use, etc.

Filing cross-border transactions with the tax bureau

The procedures for filing cross-border payments and declaring taxes with the tax bureau can be long-winding due to necessary steps and documentation to complete the process. Below is the outline of the procedures one has to go through. If you need assistance, you may contact us to help you conduct the more detailed process of withholding taxes for cross-border payments.

- Tax registration for non-China tax residents

- Preparation of contracts and registration with the Chinese tax system

- Back filing or preparation of documentation for external payment as required by China’s State Administration of Foreign Exchange (SAFE)

- The judgment of the transaction if the tax treaty is applicable and preparation related documents

- Declaration and payment of taxes

In order to complete the cross-border transaction for non-trading offshore payment, the individual or organization needs to also complete the documentation required by the bank and fill in the “non-trading offshore payment” form.

Below is the list of document required for bank payment:

- Tax back filing form for outbound payment (税务支付备案表);

- Service agreement or contracts (for service, royalties, interest, property transfer);

- Resolution of the board of directors or shareholders (for dividends payment only);

- Audit reports and capital verification report (dividends payment only);

- Invoices (for service, royalties);

- Tax payment proof (CIT, VAT, and surcharge tax );

- FOREX remittance application form ( 境外汇款申请书).

Conclusion

China’s tax treatments of non-trading payments overseas should be taken with careful assessment. Especially, with regards to the application of tax treaties, the qualification for beneficiary owner bears more burden of proof. Furthermore, there are also other ways to qualify as a beneficiary owner apart from the negative factors mentioned. On the other hand, there could also be potential ways in which qualification for the beneficiary owner may be rejected. It is best to consult local tax professionals in China to abide by any changes in the country’s tax regimes.

Contact us

S.J. Grand provides assistance on the procedures for undertaking cross-border payments and their related tax charges. We also give advice on the various requirements related to the conditions of a “beneficiary owner” and sending dividend payments to overseas shareholders. Contact us to get you started.

Moreover, our firm utilizes an advanced Cloud solution that can make your business transactions easier with our help, contact us, or go to our Kwikdroid page to check the prices and packages we offer, no matter the size or type of company.