A VAT refund is integral to exporters’ operation in China because it eases their burden of paying for taxes. In return, increased export activities allow China’s economy to achieve global competitiveness. Especially during the current pandemic crisis, China made sure to provide immediate relief to the exporting industry. Thus, the new measure has increased the rates related to export rebates.

See more details on our previous post on Export Enterprises to Benefit from Increased Tax Rebates

Trade and manufacturing companies dominate the export industry. As such, it is important to understand the difference in the VAT refund scheme enjoyed by both sectors. Keep reading to learn more.

What are the current rates for the VAT claims in China?

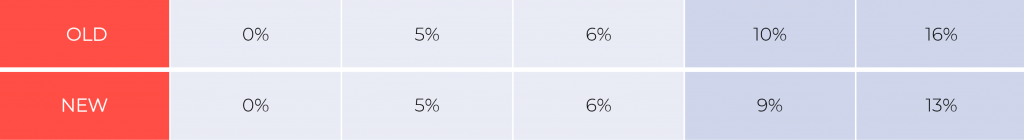

In April 2019, the Chinese government has implemented major changes to its VAT policies through Announcement 39 [2019]. It includes the reduction of VAT refund rates to 9 percent and 13 percent. Furthermore, VAT rates charged on exporters also lowered from 10 percent and 16 percent to 9 percent and 13 percent, accordingly.

Comparison between old and new rates on VAT refund

This year, the State Taxation Administration announced an increase in export tax rebates on 1,464 products amid the impact of the COVID-19 outbreak. From 6 percent and 9 percent, the tax bureau provides a VAT refund increment of 9 percent and 13 percent, respectively.

What VAT is refundable?

Both domestic and foreign export companies in China can apply for a VAT refund for goods exported overseas. They are eligible for a full or a portion of VAT refunds from the government. The VAT payments include import tax paid to customs and tax paid to domestic suppliers. Companies with export revenue may earn VAT credits which are preconditions for getting a refund.

Moreover, the refundable VAT rate depends on the commodity HS code determined by the customs department.

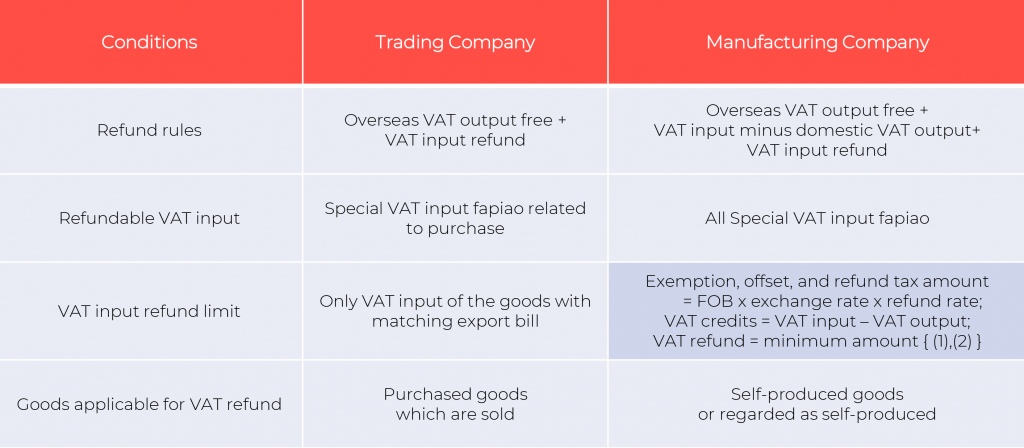

The difference in the VAT refund scheme between trade and manufacturing companies

Definition of terms

- Overseas VAT output (tax for the sales of goods overseas); Domestic VAT output (tax for the sales of goods in China.

- Special VAT input fapiao refers to an invoice general taxpayers issue to other businesses or non-consumers when selling their goods. It normally compensates for the VAT liability of the general taxpayers.

- Self-produced goods are goods a company produces or manufactures on their own instead of purchasing from other companies directly.

- FOB or Free On Board is a shipping term where the seller makes a price quotation including the cost of delivering goods to the nearest port. Hence, the buyer pays for shipping fees.

- VAT credits are deductible balance which is used to offset the input VAT against the output VAT.

Clarifications between VAT input and VAT output

VAT output is the tax charged on the sales of goods and services to consumers and other businesses. When a business is registered to VAT, it can incur VAT on each taxable item, and this should be added to the sales invoices.

On the other hand, VAT input is the tax incurred on the price of taxable goods or services being purchased. If a company is a registered VAT payer, it is eligible for a deduction of the paid VAT.

Where there is no VAT charged on the exports, the export company can recover part of the VAT input as cash through the VAT refund scheme. Trading companies are only limited to a refund of VAT input while manufacturing companies can apply for a refund of all VAT input.

To put it simply, trading companies can only get a refund of VAT paid on their purchase of taxable products. On the other hand, manufacturing companies can refund VAT paid for their purchase of raw materials as well as supplies or rental costs so long as they can get an invoice or VAT fapiao.

Key takeaways

As China’s export refund policy frequently changes, export companies need to keep an eye on what impacts them since it can also affect their pricing of goods.

Furthermore, the VAT refund scheme adopts strict compliance in the submission of required documents. Thus, exporters are advised to avoid making mistakes in filing their VAT refund claims. Any error may lead to a refusal of their claim.

Finally, export companies also need to settle payments from their customers by April 2021 next year, otherwise, it will be impossible to apply for a VAT refund.

Contact us

Our team of local and foreign experts can assist you in matters regarding your VAT refund application and procedures. Moreover, you can take advantage of our easy-to-use, 24-hour access management tool like Kwikdroid.

Kwikdroid is a Cloud-based accounting and company solution that will be made available in your workplace in no time.

S.J. Grand also offers Cloud ERP services for your business if you are currently experiencing difficulty in managing your operations amid the COVID-19 pandemic. Check out our IT services page for more details.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.