On December 31, 2019, China’s State Taxation Administration released the Tax Circular No. 44 on the Individual Income Tax (IIT) Return Procedures. It is intended to establish a “reasonable and orderly system” for tax settlements based on the Law on the Management of Tax Revenue Collection and Individual Income Tax Law.

Read our previous article on China Adopts a Revised Individual Income Tax Law

The announcement notably outlines the annual IIT Return standards and processes. Keep reading to find out how to complete your annual tax declaration procedures and get your tax refunds for this year.

Annual accounting and tax refund

The annual accounting settlement or IIT return for individual income taxpayers refers to a summary of the annual income and deductible expenses of four income types. These include wages, salaries, labor remuneration, manuscript remuneration, and royalties received from January 1 to December 31, 2019. It involves the annual calculation and the clearing of tax receivable and payables for the current year. However, the annual IIT return does not include the previous or future years and does not involve classified income such as properly leasing.

The tax refund is the final settlement process where taxpayers apply for annual tax declaration to tax authorities and settle the tax refund or payment. The annual IIT return allows a taxpayer to get a refund if more taxes have been paid in advance. Furthermore, it clarifies the tax reform benefits that a taxpayer could get. These include, for example, some special itemized deductions like education of the children, ongoing training treatments for serious illnesses, mortgage interest, rents, care for the elderly, and other pre-tax deductibles during the annual accounting period.

Taxpayers are entitled to a tax refund regardless of their income and amount of tax refunds.

Who does not need to do IIT return?

The Chinese government has initiated various tax policies that allowed low- and middle-income taxpayers to be exempted from annual accounting. Hence, the taxpayer is not required to go through annual accounting if he or she falls under the following categories:

- A total annual income of not more than RMB120,000;

- The annual tax repayment or reimbursement amount is RMB400 or less;

- The prepaid tax amount is consistent with the annual taxable amount or does not apply for a tax refund.

Furthermore, taxpayers are NOT required to do the annual IIT filing if they meet the following conditions:

- Worked for the same employer from January to December and IIT was declared properly;

- Did not make a passport change other than January;

- Did not receive other revenues other than salary.

Who is required to do IIT return?

- The taxpayer who paid in 2019 a tax advance that is greater than the annual tax payable and where a tax refund is applied;

- Taxpayer’s comprehensive income in 2019 exceeds RMB120,000 and the amount of tax repayment is more than RMB400.

Note that the annual IIT return may be conducted for employees who have changed their passports. A change of passport could be identified by the e-tax system as a new taxpayer, therefore, a passport change will lead to a tax repayment.

Deductible pre-tax deductions

Taxpayers can apply for the following additional deductions:

- Medical expenses for major illnesses of taxpayers, their spouses and children of minor age;

- Child education, higher degree education, rental or housing loan interest, pension and other special deductions for expenses;

- And eligible donations made by taxpayers in 2019.

Processing time

The taxpayer must perform the filing of the 2019 annual IIT return from March 1 to June 30, 2020. If he or she will be outside China during this period, then he or she must handle the annual IIT return before leaving the country.

Tax formula

TR/TP 2019 = [(CI – RMB 60,000 – SC – SAD) x Trate – QC (Number) – TPA]

- TR/TP: Tax Rebate or Tax Payable

- CI: Comprehensive Income

- SC: Social Contribution

- SAD: Special Additional Deductions

- Trate: Tax Rate

- QC: Quick Calculation

- TPA: Tax Paid in Advance

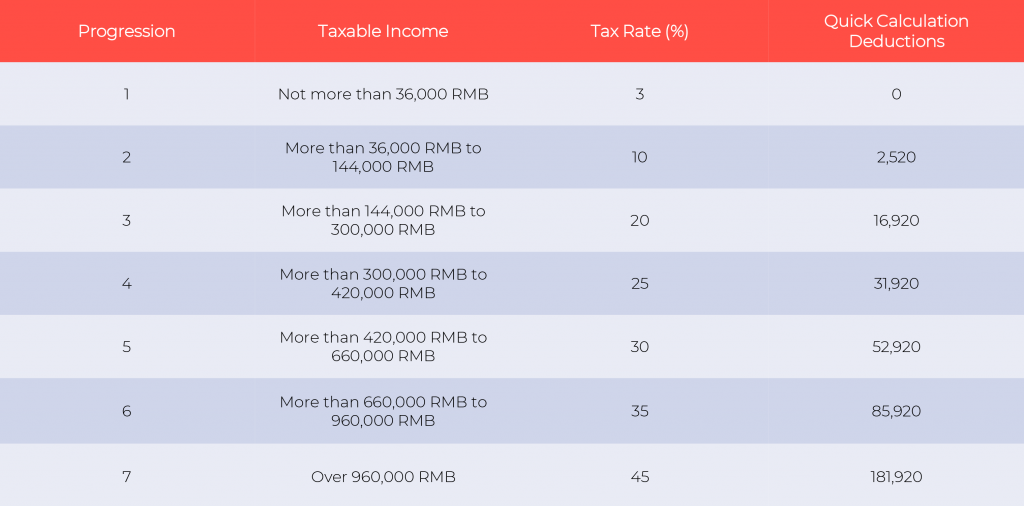

Personal Income Tax Rate

Source: China’s State Taxation Administration

If you want to know more about tax rates and get a sample tax calculation, please visit our Individual Income Tax Calculator for a reference.

Methods and Procedures

For Annual Accounting (IIT return)

How to apply

- Can apply by yourself

- Through a withholding agent

- Via a tax professional service or trustee (A power of attorney with the taxpayer is needed.)

Methods to apply

- Online tax bureau (including the personal income tax APP)

- Onsite paper filing

- Mailing to the tax service office

Processing authorities

The taxpayers handling the annual IIT return on their behalf should report to the tax authority where their residence is registered. On the other hand, the withholding agent should report to the tax authority in charge.

For Tax Refund

Application for tax refunds

- The taxpayer should provide an eligible bank account opened in China.

- Moreover, it should be handled where the taxpayer’s household is registered.

- In the case of corrections, the tax authority will notify the taxpayer and tax refunds will be handled only after the corrections.

- To get the tax refund ASAP, the amount should not exceed RMB60,0000.

Methods to apply

- Apply through the online refund function of the State Taxation Administration (including the tax deduction app).

- Get refunds through online bank transfer, POS card swiping, bank counters and non-payment bank institutions.

Tax refund application authorities

For taxpayers handling on their behalf

- If employed, the taxpayer reports to the tax authority located at his or her employer’s address.

- If unemployed, he or she then goes to the tax authority at his or her residence. It is the address of the place of residence listed in the residence permit.

For taxpayers with a trustee or withholding agent

- The trustee or withholding agent reports to his or her respective tax authority. For employees who have changed their jobs, the company as the withholding agent will be in charge of updating the tax information.

Processing time

The taxpayer with a small tax refund request can process from March 1 to May 31 through the methods provided.

Annual accounting services

Aside from the provision of optimized services such as the personal income tax app, tax bureau website, 12366 tax service hotline and other channels, the tax authorities also offer personalized accounting services for the elderly and disabled persons.If you need help with conducting your IIT return, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!