A company closure due to profit loss is the worst thing that could happen to your business. But if it is not because of the poor handling of your business, this situation can also happen due to an economic impact caused by an unexpected crisis such as the current COVID-19 pandemic. As an investor, you can opt to sell your company or shut it down for good.

Read our previous post about the Tax Implications of Selling Your Company in China

If your business is heavily affected by such a crisis, a company closure may have already crossed your mind. Doing business in China and saying goodbye to it are equally hard. But the latter may bring consequences if not properly executed. Learn more!

Reasons for closing a company

Businesses have a variety of reasons for shutting down, but mostly it is because of an economic or financial crisis. Another reason for closing a company includes retirement, loss of investors, or cessation of operations due to selling or filing of bankruptcy. The latter, however, is the least complicated way to close a company in China.

Companies with a bad financial situation can file for bankruptcy liquidation then stop doing business all at once. However, it should be noted that even though you can get away with the hassle, you must pay a price for choosing this step. It is rather expensive as it entails a one-time payment of all necessary costs such as salaries, taxes, or debts.

But there are other options to close your business such as both formal and informal ways. Find out in the preceding section.

Other options for business closure

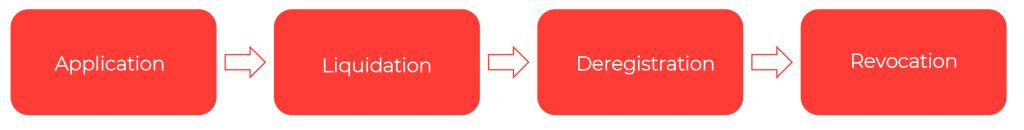

Dissolution and deregistration

- First, submit a dissolution application to the authorities including the Ministry of Commerce, Administration of Industry and Commerce, Statistics Bureau, Ministry of Finance, State Taxation Administration, and State Administration of Foreign Exchange.

- Then, prepare for the liquidation of assets, payment of debts, and distribution of remaining assets to investors. Submit the liquidation reports to the authorities,

- After that, follow tax deregistration procedures and obtain deregistration certificates from various departments. This also includes the deactivation of all bank accounts.

- Finally, wait for approval and revocation of license.

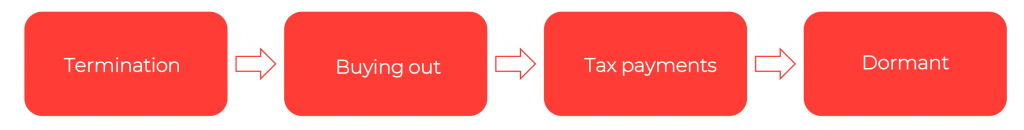

An informal closure or becoming dormant

- Terminate all employees and compensate them according to Chinese labor and contract laws.

- Make a lease buyout and negotiate with Chinese landlords. Or, simply let any existing lease expire.

- Pay for all government taxes and pensions.

- Stay dormant and then, get back to business.

Advantages of informal closure or becoming dormant

Although considered as a temporary solution, most companies especially foreign-invested enterprises push for becoming a dormant company. This is because it is a lot cheaper and allows you to return to China and restart your business if you want to. Furthermore, payment of government taxes is minimal and it gives you the chance to run entirely unless a formal shutdown is finally demanded.

Download our free guide to business continuity here and consult with our team for further assistance.

The dormancy option keeps your company active while paying for minimal taxes. This means that you can resume your business at any time.

Related documents needed for company closure

- Termination application form

- Liquidation report from a Chinese auditing firm

- Auditing report and related tax documents

- Separate application by the holding company

- Board resolution agreement or statement

- Certificate of approval from tax district bureau

- Certificate of tax payment completion

- Deregistered Foreign Exchange Registration approval certificate

- Deregistered bank accounts, registration certification, enterprise code certificate, and statistics certificates

- Notice of cancellation or dissolution

- Canceled commerce commission and seal

Processing time

With the development and streamlining of business procedures in China, the dissolution process takes about 3 to 6 months, depending on the accuracy and completion of the requirements.

Consequences of improper company closure

- Inclusion among the blacklisted companies

- A reputation of being a blacklisted company

- Ban from China entry-exit including foreign employees

- No more opportunity for future business

- Criminal and civil liability

Key takeaways

To avoid delays in closing your company, it is important to be fully compliant with the current rules and regulations. Especially, closing for your taxes is crucial to avoid any conflict with the tax authorities. It should also be noted that anyone involved in the company such as your former employees and investors can face arrest or ban from entry to China if your company does not follow proper closure procedures.

Moreover, you have to ensure that IIT payments for your employees and other pending taxes are fully paid. Besides, you will have to continue paying for your office rental during the process of canceling relevant certificates.

Lastly, you have the responsibility to clear your company from any lawsuit to save yourself from possible arrests.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!