If you are a foreigner who has been living in China since January 1, 2019, it may be the right time to consider leaving the country each year. The new rule on tax residency gives tax privileges for foreigners who have stayed in China for less than 183 days in a tax year.

Read our previous post about China Announces Preferential Visa Policies for Foreigners

Aside from tax exemptions based on residency, foreigners also continue to enjoy other tax-related benefits. Read and take advantage of China’s special policies for foreigners.

The new six-year rule for foreigners

Under the newly implemented IIT regulations, a non-domiciled, resident individual is subjected to tax on worldwide income if he or she stays in China for 183 days or more each tax year for six consecutive years. That is to say that a foreigner must pay taxes on income not paid by a Chinese domestic entity or a resident individual.

However, the new six-year rule also stipulates that a foreigner does not need to pay taxes on overseas income if he or she meets the following conditions:

- Less than 183 days of stay in China (considered as one tax year)

- Single departure from China for over 30 days straight at any point in time during the six years

If a foreigner is non-domiciled and resides in China for less than 183 days in a tax year but more than 90 days, he or she is considered a non-resident taxpayer. This also means that he or she will only pay for a China-based income source.

Foreigners cannot be domiciled unless they reside in China due to household registration, family ties, and economic involvement. They are non-domiciled since they reside in China for short-term purposes such as study, work, family visit, and tourism. Hence, foreigners cannot be domiciled due to visa constraints.

In practice, all PRC nationals are treated as tax residents in China unless they immigrate.

Also, check out relevant information on How to Get a Permanent Residence Permit in China

The 24-hour rule

In relation to the 183-day rule, if a foreigner is in China for less than 24 hours, it will not be counted as a day of residence. To put it simply, only the days of stay in China are accounted for 183 days needed to be a tax resident.

Recalculation of years of residency

Since the new six-year rule was implemented in January 2019, foreigners who have lived in China cannot count the previous years of their stay in the country. This means that the tax exemption will only apply after the calculation of years of stay beginning January 1, 2019. Therefore, a foreigner must calculate the period of residency starting from this date. And to enjoy the tax exemption, he or she must leave China BEFORE 2025, six years from the date of calculation.

Nevertheless, foreigners who have already stayed in China for 183 days or more for six consecutive years and did not leave the country for 30 consecutive days can reset the “six years” of stay beginning from January 1, 2019, and still benefit from the tax exemption given that they meet the requirement.

Tax benefits for foreigners

China’s State Taxation Administration through Circular No. 164 announced preferential policies that will be applied to foreigners from 2019 to 2022. Foreigners can enjoy either special additional deductions or tax exemption from January 1, 2019, to December 31, 2021. However, the tax authorities also confirmed that from January 1, 2022, foreigners can only take advantage of the special additional deductions.

The following are the coverage of tax benefits foreigners can enjoy.

Scope of tax exemptions for foreign individuals

- Housing and food subsidies, laundry fees, relocation fees

- Subsidies for domestic and overseas business trips

- Family or home visit fees, language training fees, and children education subsidies

- Handling fee for withholding tax payments

- Bonus for individual reporting and assisting in the investigation of various illegal crimes

- Sale of residential housing which has not been lived for at least 5 years

- Dividends and bonuses obtained from foreign-invested enterprises (FIEs)

- High-level foreign experts who meet certain conditions

Special additional deductions

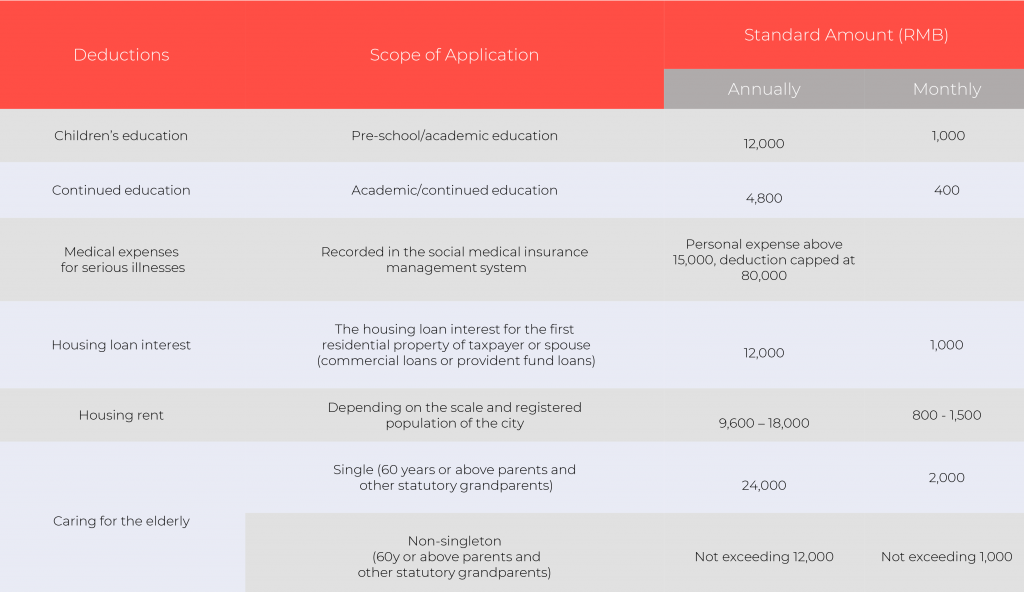

The table below shows the coverage of the special additional deductions for foreigners.

*Previous annual deduction for medical expenses for serious illnesses was capped at RMB60,000.

*The previous monthly amount for housing rent was from RMB800 to RMB1,200. Thus, it increased by RMB400.

*Foreigners can deduct RMB1000 per month for each child.

Conclusion

China deems the six-year rule on tax residency as a way to attract more foreign talents in the country. From the previous five years, the government further relaxed the policies concerning foreigners’ tax residency status.

Moreover, Hong Kong, Macau, or Taiwan residents who frequently travel to Mainland China for work can benefit from the new rule. They can apply the 24-hour rule if they leave China for certain days.

On the other hand, the respective local governments may have different rules regarding the tax benefits for foreign individuals. Therefore, it is best to consult a local expert for further clarification. You may contact us and consult with our tax advisors for urgent assistance on this matter.

Contact us

S.J. Grand specializes in advising foreign individuals and business owners on matters related to tax and accountancy in China. Contact us to avail of our special services.

Moreover, if you are interested in our latest Cloud-based company solution, go to our Kwikdroid page to check the prices and packages we offer, no matter the size or type of company.