China’s State Council announced a new tax incentive for the tech industry, particularly the integrated circuit (IC) and software industry. In its new policy, China aims to promote the “high-quality development of the integrated circuit and software industry in the new area”. Thus, one major policy support includes tax exemptions to high-tech enterprises such as IC and software companies.

Read our previous article on Tax Incentives for High Tech Enterprises in China

China targets the strengthening of its domestic software industries through various policies. Keep reading to find out more specific details about these policies.

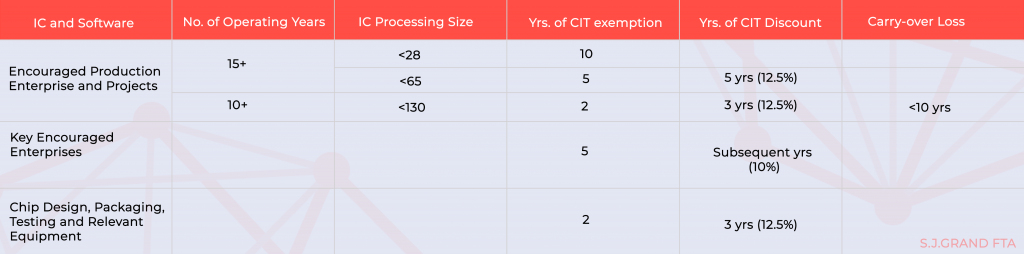

Corporate income tax exemption for IC and software industry

IC companies may be exempt from paying corporate income taxes (CIT) depending on two factors:

- the number of operating years and;

- the size of IC projects.

The tax relief period starts from the first profit-making year of IC manufacturing enterprises. For IC production projects, the preferential period will start from the tax year when the project first obtains its production and operating income.

IC enterprises operating for more than 15 years with projects using less than the 28-nanometer processing size will be exempt from CIT for up to 10 years. On the other hand, those that use less than 65nm will be exempt for five years. For the following five years, they will get a 50 percent discount on their CIT. To note, the statutory CIT rate for tech enterprises is at 25 percent, which means that the tax cut will be at 12.5 percent. On the other hand, the statutory CIT rate for an IC and software company qualified as a high-and-new technology enterprise (HNTE) is at 15 percent.

Also, check out our guide on Technology Enterprise Registration for SMEs in China

Meanwhile, software enterprises involved in chip design, packaging, testing, and relevant equipment will be exempt from CIT for two years. For the following three years, they will enjoy a 12.5 reduced CIT rate as well. Key encouraged enterprises will also be exempt from CIT for two years and will get a 10 percent reduced CIT rate in the subsequent years.

Summary of tax incentives for IC and software enterprises

Exemption of import tariffs for IC and software products

Within a given period, IC manufacturing enterprises will be exempt from import duties based on certain criteria. The following manufacturers will be duty-free for their imports for the self-use of raw materials, equipment, spare parts, technologies, etc.

- Producers of logic circuits with integrated line widths of less than 65nm;

- Memory devices and enterprises producing featured ICs with line widths of fewer than 0.25 microns. These include enterprises producing masks and silicon wafers of 8 inches or more;

- Compound IC manufacturers and advanced and testing companies with integrated line widths of less than 0.5 micrometers;

- Key IC design and software companies;

- IC production and advanced packaging and testing companies.

In addition, IC enterprises with significant projects will be allowed to pay import VAT through installments. The General Administration of Customs and other relevant authorities are in charge of specifying the details of this scheme.

China’s new policy also stresses the establishment of overseas marketing networks. Hence, the development of international services outsourcing businesses is seen to promote the export of IC and software services.

Financing semiconductor companies through STAR market

China also encourages qualified IC and software enterprises to list at home and abroad with Shanghai’s STAR market as the preferred capital-raising venue.

Learn more about Star Market: Shanghai’s New Stock Exchange

Through public listing and raising funds, related international enterprises will have the opportunity to establish R&D centers in China with the cooperation of domestic tech companies.

The Chinese government aims to intensify global cooperation in the development of semiconductor products and technologies such as high-end chips and IC equipment, key materials, and design tools. Thus, China expects domestic and foreign chip makers to work together toward more innovation.

Other financial-related support

The new policy also promotes a commercial loan mechanism to be established by the local governments to support IC and software enterprises. Moreover, financial institutions are called on to improve their financial services and increase long-and-medium-term loans to the industry.

Conclusion

The ongoing tech war with the U.S has prompted China to further boost its IC and software industry. However, the tax incentives given to the industry are yet to bear a major impact.

Nevertheless, China continues to make its semiconductor market more appealing to foreign investors by further allowing foreign capital and overseas participation in the IC and software sectors.

Contact us

If you want to know more about doing business in China and need a consultation on how to invest in the tech industry, contact us to avail of our specialist services.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!