The outbreak of the coronavirus has forced the Chinese government to set new labor regulations, leaving many enterprises with no choice but to follow the government’s emergency measures. Thus, the impact of COVID-19 on businesses has resulted in the government’s establishment of new rules that every employer should know.

Take a look at our previous article about COVID-19: What Foreigners in China Need to Know

This article outlines various employment-related policies including termination of a contract, partial employment and other important updates. Keep reading to learn more!

New labor rules on employment

The government encouraged employers to take particular care of workers in key affected areas such as Hubei. According to the joint notice for epidemic prevention and control, unemployment benefits should be given through the unemployment insurance fund. The rate of the benefit is not higher than the unemployment insurance standard. Also, the specific standard depends on the local government.

On the other hand, the government advised employers not to prevent the recruitment of workers coming from severely affected areas. In other words, companies should not refuse a job applicant from a key infected area.

Furthermore, the labor authorities warned employers NOT to terminate employment contracts or force normal labor if the employee is unable to return to work due to the epidemic situation. According to Article 87 of the Contract Law of The People’s Republic of China, if the employer terminates a contract illegally, it can risk paying twice the rate of the severance pay as stipulated in Article 47 of the same law.

However, employers can delay or postpone the payment of wages if they have difficulty meeting their production and operation.

Meanwhile, the government also established employment support for college graduates. For the time being, on-site recruitment is suspended and all related activities should be done online. Some requirements such as physical examination can also be postponed.

Support for SMEs

During the outbreak, small and micro enterprises get priority support from the government. SMEs can take advantage of special incentives and reduced rental fees.

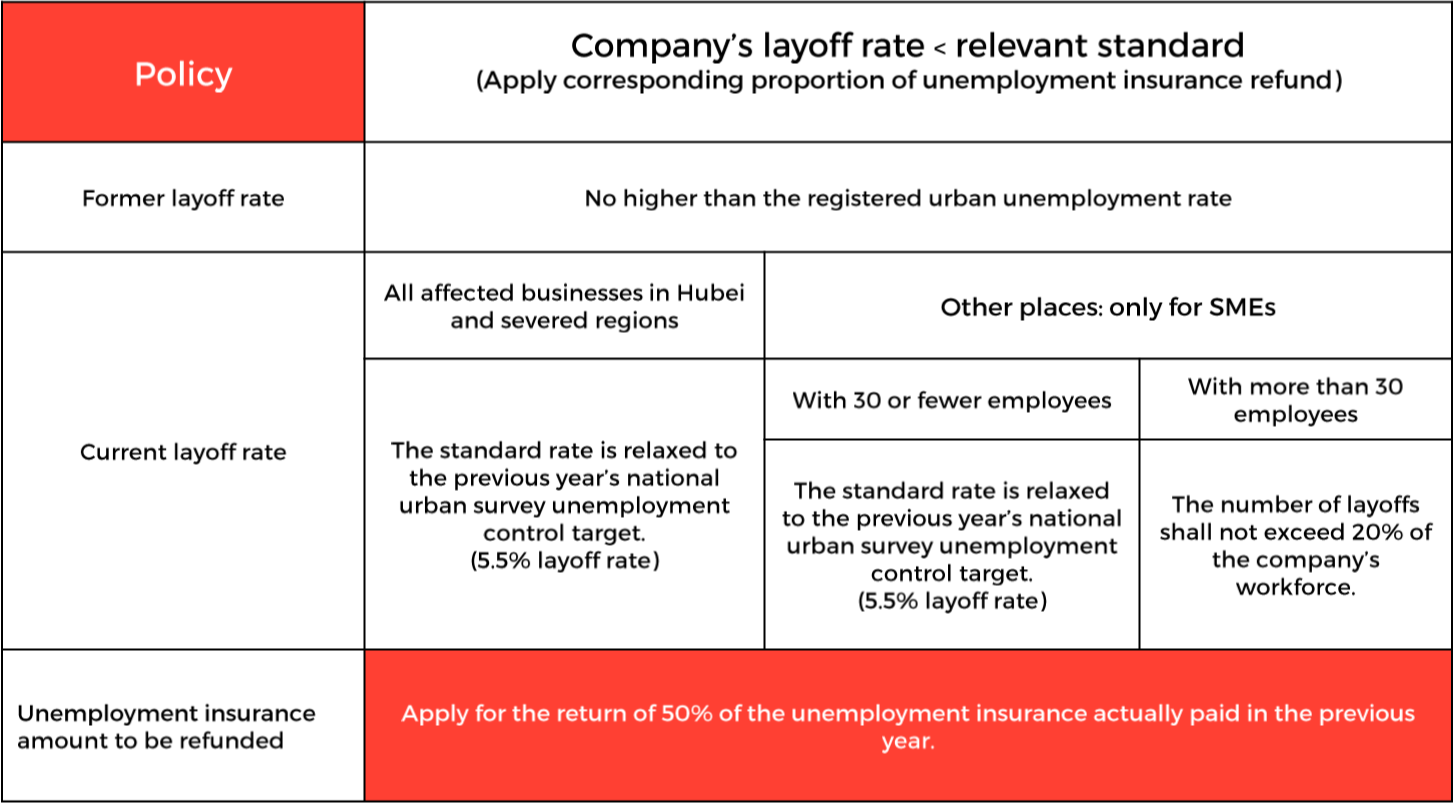

Moreover, under the enterprise return policy, employers can claim unemployment insurance that they paid in the previous year. This applies if they laid off fewer workers during the epidemic. Many local governments in China implemented this policy and they returned a total of about RMB 11,000 billion in unemployment insurance. See the table below for more information on the policy.

To claim the unemployment insurance refund, the following platforms can be used:

- The official website of the Ministry of Human Resources and Social Security

- WeChat public account:Search “人力资源和社会保障”

- 12333 national insurance public relations service platform

- Download the APP: Handheld 12333

Social security management

Due to the impact of the COVID-19 epidemic in China, the labor ministry called on employers to handle their employee’s insurance registration and payment insurance services within the time limit. Furthermore, overdue payments should not affect the insured employee’s track record.

Read more on Social Insurance Cuts to Help Small Enterprises in China

Employer-employee labor relations

On partial employment and resumption of work

Employers can negotiate with their employees about the terms of labor during the epidemic control period. According to the Ministry of Human Resources and Social Security, enterprises can make salary and work schedule adjustments. This applies if they are facing difficulty in production amid the impact of the epidemic. However, employees get to be entitled to a wage payment of not lower than the local minimum wage standard. If an employee is unable to provide normal labor, the employer must pay the basic expenses according to the local living standard.

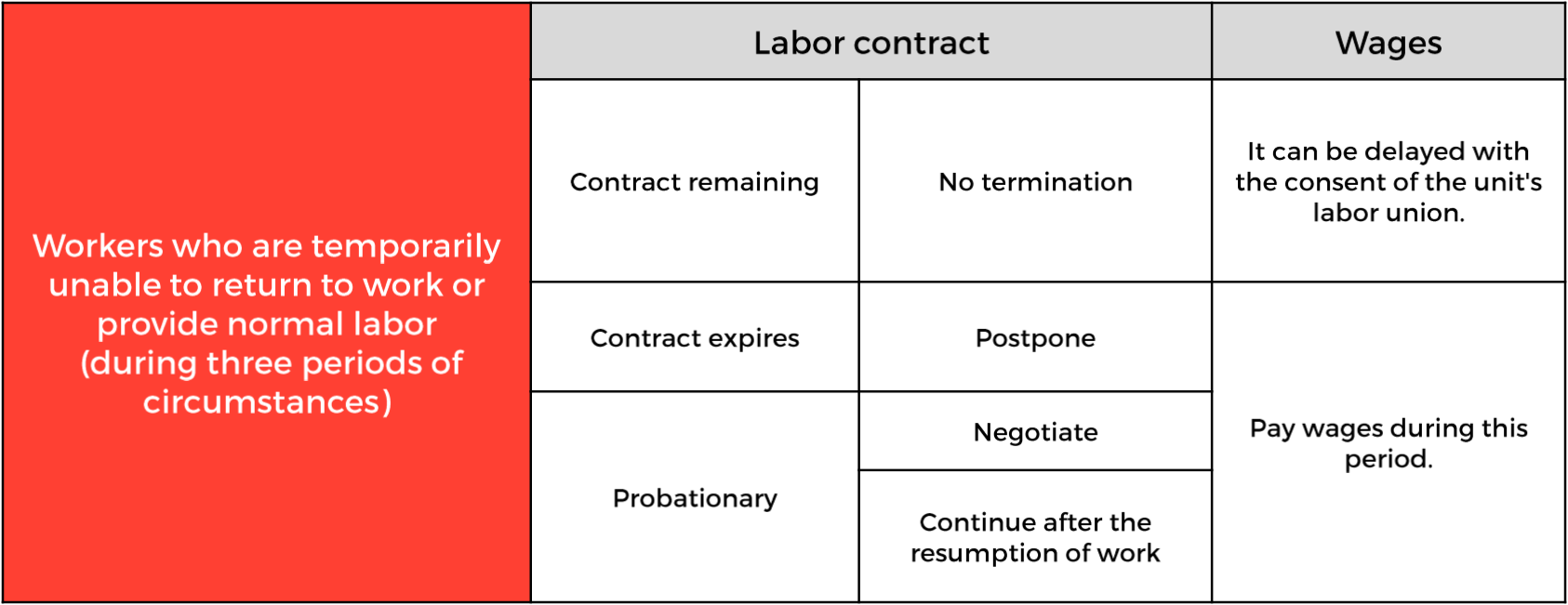

If, after the medical observation or quarantine period, the employee continues to rest at home, employers can provide necessary payments accordingly. Employers can inform the employee to apply for sick leave (if there is a medical certificate), or apply for leave in the absence of a certificate. See the tables below for more details.

1. Circumstances of an employee during the epidemic

2. Terms of employee’s contract and wage payment

On related arbitration or “force majeure”

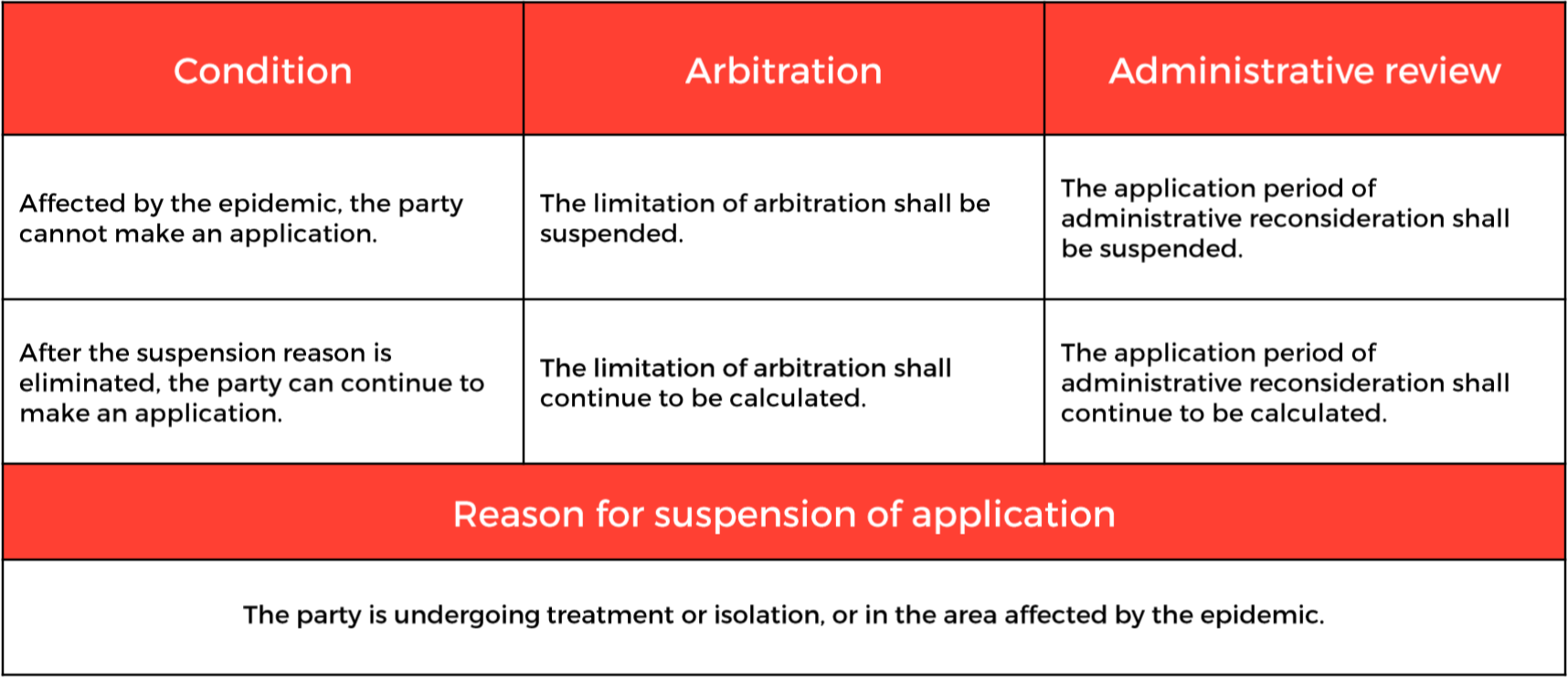

In legal terms, a force majeure refers to circumstances that prevent someone from fulfilling a contract. According to Article 26 of the Labor Law of The People’s Republic of China, concerned parties may terminate a contract due to force majeure or failure to abide by the state regulations on labor protection. The coronavirus epidemic may fall under force majeure as an unforeseeable event. Therefore, employers need to understand its applicability in case of labor contract disputes where arbitration can be enforced. If the concerned parties do not agree with the fines or penalties imposed, they can apply for an administrative review for reconsideration. See the table below for the details of arbitration.

COVID-19 guide for employers

One of the ways employers can avoid labor disputes in these uncertain times is to make sure that employers are protected and receiving support. Thus, companies can implement several precautionary measures to respond to the needs of their employers.

If you want to know how you can deal with the coronavirus threat to your overall business operations, check out our COVID-19 guide for businesses and download it for free.If you want to know more about doing business in China during the coronavirus outbreak, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!