To support economic growth and to fight the effects of the COVID-19 pandemic, China’s State Taxation Administration unveiled a series of tax measures supporting enterprises and individuals. Moreover, the bureau also secured policies that include social insurance exemptions and the reduction of medical insurance fees. This move will allow many enterprises to earn savings despite the impact of COVID-19 on their businesses.

Check out for more information here: Enterprises to Save from Social Insurance Exemptions

The tax policies cover enterprises and individual workers who are affected as well as involved in the prevention, control, and treatment of COVID-19. Keep reading to learn more!

Tax support for COVID-19 frontliners

Medical staff and workers involved in COVID-19 prevention and treatment are exempted from individual income tax. They will also receive temporary work subsidies and bonuses according to specific standards set by the government at all levels.

Other personnel who participated in the coronavirus control and prevention will also get temporary work allowances and bonuses according to the provincial level. They are also exempted from paying individual income tax.

Preferential tax policies for the production of materials and delivery of services

On February 6, 2020, China’s STA also released preferential tax policies for enterprises and individual taxpayers providing materials and services during the COVID-19 period:

Enterprises producing key materials can get a full refund of tax credits for the incremental VAT. On the other hand, they can also get a one-off deduction before corporate income tax (CIT) for newly-purchased equipment intended for expanding production capacity.

Taxpayers providing the following services will be exempt from paying VAT for their income:

- Transportation of essential materials

- Public transport services

- Life services

- Express deliveries for necessities

Imported materials for direct use in COVID-19 prevention and control are also duty-free. The preferential tax duration starts from January 1, 2020, until the end of the pandemic control and prevention.

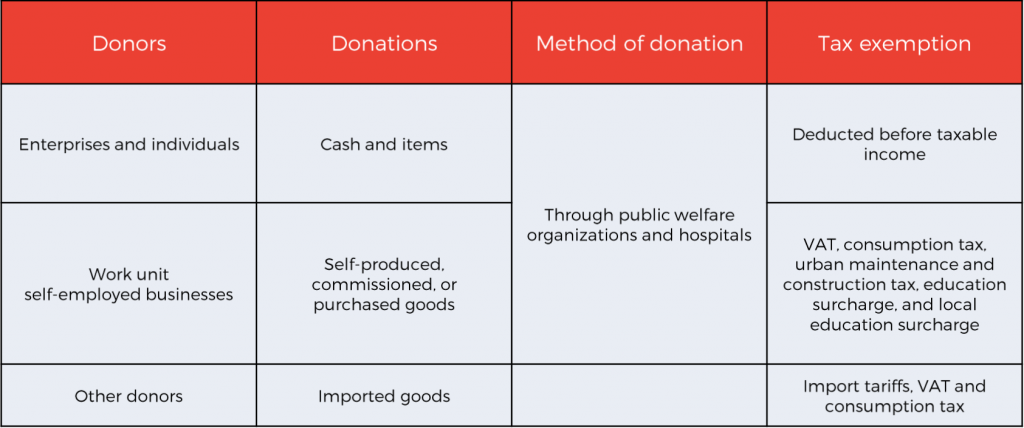

Policy support for donations

According to Announcement No. 9 regarding public welfare donations, donors of goods and items related to COVID-19 will receive preferential treatment on their income taxes. See the table below for more information about the types of donations:

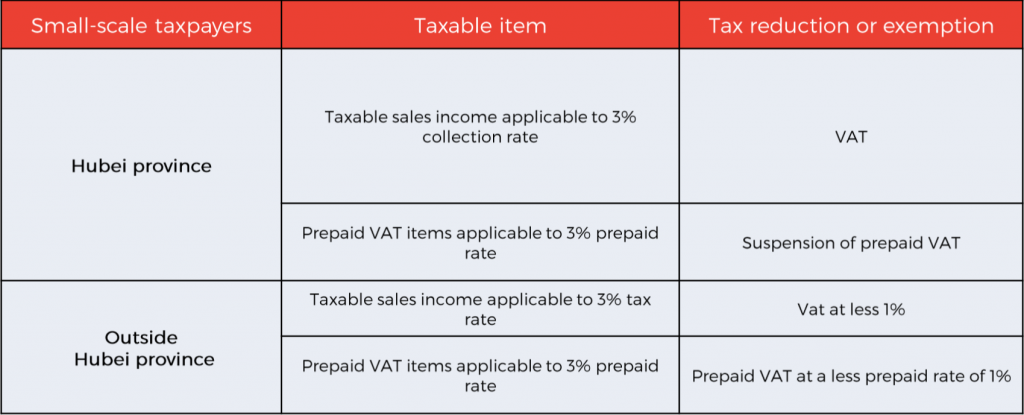

Tax policies on the resumption of work and production

Enterprises that experienced difficulties due to COVID-19 will have their losses carried-over for eight years. These enterprises fall into the following industries: transportation, catering, accommodation, and tourism. Furthermore, small-scale taxpayers will also receive preferential treatment from March 1, 2020, to May 1, 2020. See the following details of VAT reduction or exemption:

Extension of tax declaration

To ease the burden of catching up with tax deadlines, the tax authorities further extended the tax filing deadline from February 28 to March 23. However, STA also announced that the declaration period may be extended for the areas that are still in the first level of response to COVID-19 prevention and control.

The tax declaration period for service charges involving withholding tax collection in 2019 is extended from March 30 to May 30, 2020.

Taxpayers who are reporting monthly or quarterly may declare taxes until April 24, 2020. Those who will still have difficulty fulfilling this obligation may apply for further extension to respective tax authorities.

Meanwhile, Hubei province may extend tax declaration following the circumstances.Preparing financial statements and monthly tax reports can be a tedious function for your business. Hence, it is necessary to have the right tools that will maximize your efficiency at all times. If you want to optimize and have full control of your business operations, check out Kwikdroid.

Kwikdroid is an all-in-one Cloud tax, and accounting solution and company management tool. Get access to your standardized financial reports, anywhere and anytime.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!