China continues to expand its high-tech development with its increased spending on the research and development industry. As this happens, the government also constantly modifies its tax incentives to high tech companies to further encourage innovation in this area.

Have a look at our article on China Among World’s Top 15 Innovative Economies

Since 2017, the State Taxation Administration has offered preferential tax treatments for High-and-New Technology Enterprises (HNTEs). It has also further broadened its scope related to tech-based SMEs (TSMEs) and advanced service enterprises. Keep reading!

Incentives on the taxable income of high-tech companies

High-and-New Technology Enterprises are vital for establishing China’s innovative economy. Therefore, China has set tax incentives on the high tech industry as one of its core policies. Taxation authorities have allocated various tax benefits including tax exemption, super deductions, and extension of the loss-carryover period for HNTEs as well as TSMEs.

The following are the details of major tax incentives for HNTEs and TSMEs:

- Reduced corporate income tax (CIT) rate of 15 percent (previously 25 percent)

- Tax reduction or exemption on income from technology transfer

- 10 years as maximum loss-carryover period (previously 5 years)

- 175 percent super deduction of R&D expenses (previously 150 percent)

Previously, only TSMEs are eligible for the 175 percent super deduction rate. However, the taxation bureau has expanded its applicability to all other enterprises from January 1, 2018, to December 31, 2020.

In May 2019, the STA and the Ministry of Finance jointly announced the reduction of CIT for integrated circuit (IC) design and software companies by 50 percent. Announcement 68 stated a two-year exemption and three-year reduction incentive where CIT exemption applies for two years, while the following three years will be 50 percent.

What are the tax incentives for TASE?

TASE or Technology Advanced Service Enterprises refer to enterprises having agreements with an overseas entity regarding outsourcing services. Such services include Information Technology Outsourcing (ITO), Business Process Outsourcing (BPO), or Knowledge Process Outsourcing (KPO) services.

Like HNTEs, TASEs can also enjoy a reduced CIT rate of 15 percent. Furthermore, the education and training expenses of TASE’s personnel can be deducted from their taxable income for a maximum of 8 percent. This is much lower than the statutory rate of 2.5 percent. According to Announcement 79 on the expansion of nationwide CIT policies for TASEs, if the expenditure exceeded 8 percent, the remaining part can be carried forward in the next fiscal year. As of 2019, this incentive was also extended to all other industries besides high tech.

Eligibilities for HNTE, TSME and TASE status

For HNTE

The following are the qualifications for enterprises to be classified under HNTEs:

- Having one year or more registration in Mainland China;

- Owning the intellectual property (IP) rights of the core technology transfer for the last 3 years;

- Conducting business in qualified high-and-new technology sectors;

- With more than 60 percent R&E expenditure within China; more than 60 percent total revenue from HNT products and services;

- Continual R&D activities and technological advancements using its IP developed into products and services;

- 10 percent of employees are engaged in R&D work; among them, 30 percent must have at least an associate degree.

In the last three financial years, R&D expenditure accounts for not less than:

5% if the latest annual sales income is less than RMB 50 million;

4% if the latest annual sales income is RMB 50 million to RMB 200 million;

3% if the latest annual sales income is more than RMB 200 million.

For TSME

- Must have a tech project;

- Having a normal status;

- With less than 500 employees;

- With less than RMB 200 million sales and less than RMB 200 million assets ;

- Most turnover must be from technology services or products.

For TASE

- Must be legally registered in Mainland China;

- The products (services) of the enterprise fall within the recognized scope of qualified technological services such as ITO, KPO, and BPO;

- Must adopt advanced technologies and possess R&D capabilities;

- More than 50% of the total number of employees of the enterprise have a college degree or above;

- Derived income from the provision of such services is more than 50% of the enterprise’s total annual income;

- Income from offshore service outsourcing business is less than 35% of the enterprise’s total annual income.

China’s reason for R&D incentives

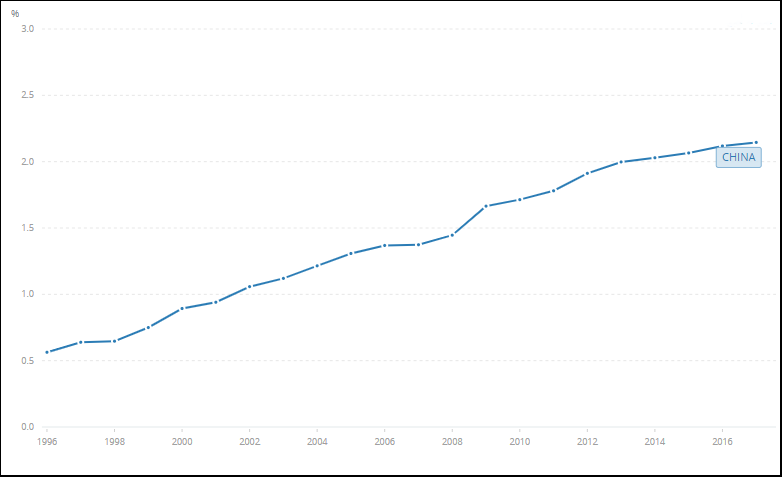

Incentivizing the R&D industry is China’s main thrust toward becoming an innovation powerhouse and attracting technological investments. According to the World Bank data, the research and development expenditure accounts for 2.15 percent of China’s overall GDP. Furthermore, the data show a continued rise in the R&D industry’s expenses from 1996 to 2017.

Source: The World Bank, Research and Development Expenditure (% of GDP)

In 2018, the National Bureau of Statistics has recorded a total of more than RMB 3.5 trillion (about USD 492 million) worth of R&D expenditure for high tech industries. This was higher than the country’s total expenditure in 2017 of about RMB 3.2 trillion (about USD 450 million). China’s STA also noted that a total tax reduction of RMB 279.4 billion (USD 39.7 billion) in the same year, where parts of this were attributed to the increased in super deduction rate.

China’s spending on R&D is consistently rising as a result of its digitalization and technological advances. Furthermore, the race for 5G development makes it even more necessary to ramp up financial support for companies in the field of technology.

Industries with R&D activities

- Telecommunication

- Mining

- Construction

- Food and Beverage

- Banking and Finance

- Aviation and Aerospace

- Nuclear Technology

If you want to know more details about how to invest and register for the R&D industry, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.