Enterprise or individual taxpayers in China who provide cross-border or overseas services can enjoy a VAT exemption following China’s taxation rule on cross-border activities. On the other hand, overseas suppliers or providers may also not pay taxes on income derived from cross-border service transactions. Furthermore, small and micro-businesses in China can enjoy tax breaks following updated tax rules and regulations.

Have a look at our previous article on Small and Micro Businesses Enjoy Tax Breaks in China

What are the procedures concerning the exemption of VAT for selling services or intangible assets overseas? What are the conditions for a tax exemption? Learn more.

VAT exemption for cross-border services

According to Announcement [2016], No. 29 of the State Taxation Administration, some of the major cross-border service transactions that are exempted from VAT include:

- Services related to mineral resources or engineering project construction, supervision, and exploration that occur overseas;

- Postal, delivery, and insurance services for export goods;

- Intellectual property, authentication, and consultation services;

- Professional and technical services;

- Telecommunication, broadcasting, and advertising services;

- Business support and human resource services;

- International transportation and logistics auxiliary services;

- Warehousing services and leasing of tangible movables used overseas;

- Financial and insurance services;

- Culture, sports, education, medical and travel services.

Zero-rated VAT service transactions

The zero-rated VAT transactions subject to simple tax calculation method but can apply for a VAT exemption include:

- International and space transport services

- Research and development services

- Energy management contracting services;

- Design services;

- Production and distribution of radio and television programs (works);

- Software services;

- Circuit design and testing services;

- Information system services;

- Business process management services;

- Offshore service outsourcing business;

- Transferred technologies to overseas technologies.

Note that the input VAT for the export of services can be refunded or deducted from VAT payable under the zero-rated VAT transaction. However, obtaining a tax refund for this kind of transaction is complicated and time-consuming.

Procedures for claiming VAT exemption

To be eligible for the VAT exemption, the taxpayers must present a written contract between the service provider in China and the receiving overseas enterprise or individual. The contract will serve as proof that the income of the sale of services or intangible assets is entirely sourced from overseas. Thus, it must be accounted for separately.

List of documents to be submitted

- Contracts for cross-border sales of services or intangible assets

- Evidence of service location outside China

- Proof of international transportation business

- A proof that the purchaser’s agency is located overseas

- Declaration for forfeiture of applicable zero-rated VAT

- Basic information of taxpayers and business introduction

- Tax treaties and international transport agreements

- The first page of the exit document and exit record of outbound business personnel

- The first page of the exit document and exit record of the buyer’s of travel services

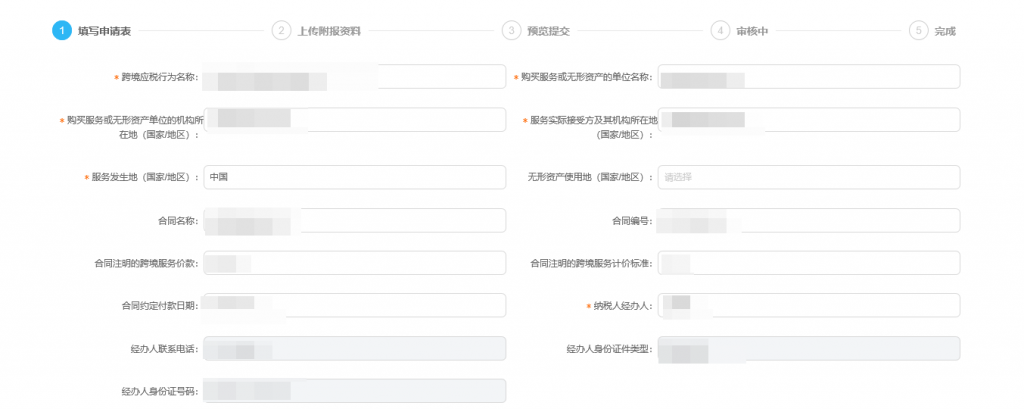

The application for the VAT exemption is straightforward using the tax bureau’s e-tax system. After completing the form and uploading the necessary materials, the tax authorities will send a notice within one to three working days.

E-tax form for VAT exemption declaration

The e-tax form must contain the name or type of cross-border transaction, name, and country of the purchasing company overseas, location of the actual recipient of the service, and the place where the service transaction occurred.

After receiving the notice from the tax bureau, the taxpayer can now go through the declaration of the tax-free amount and wait for approval.

Key takeaways

The taxpayer should declare the tax exemption not later than April 30 of each year during the corporate income tax settlement period. Furthermore, the required written contract must have a Chinese translation and the signature of the legal representative or the company’s seal.

For zero-rated services, it should be noted that a special VAT invoice cannot be issued. Hence, taxpayers under this transaction must present relevant permits, licenses, or certificates.

(This article was published on July 21, 2020, and was updated on February 19, 2021.)

Contact us

If you want further assistance with VAT exemption application procedures for your cross-border transactions, contact us to get you started. Also, visit our tax and accountancy page to see more details of our specialist services.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer and send us a demo request.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.